| TradeWithMe |

MY STYLE - BLOG

|

Noiseless trading has been the focus of my work in recent months. These are approaches different from the usual Renko, Kagi and Point and figure approaches, but use an approach that reduces or eliminates the confusing mini cycles of price movement in a large trend which typically cause whipsaws, much to a traders chagrin.

The effect of the approaches which include signal and amplitude modulation is improvement in trading efficiency. This knowledge is being shared with participants in the mentored training and trading programs.

0 Comments

After a gap of 10 months during which I was learning non trading skills such as Tennis and Bridge, I am back here.

WIll be beginning updation of the website with newer and interesting materials progressively, which you can track through the change tracker. In the meanwhile, the markets continue to move from strength to strength. Once again, if you invested long term in blue chips that were hammered during the commodity crash/scam news period, you would have made significant gains. Examples - HINDALCO and TATA STEEL. There are safe ways of investment trading - the simplest being invest long term. There are others that I cover in my mentoring sessions, which have continued through the period that I have not been active here. After several years of offering trading services, I am now focusing all my time on providing Mentored services for trading here and Mentoring or Life Coaching through another site of mine. This enables me to maximize my productivity.

The technical analysis sections here will continue to be updated from time to time. An interesting blog that I am copying and posting verbatim - (Jim Somers at www.join.me) - this is my lifestyle since the last 5 years...... Having the ability to work from home has become the new norm across many industries and roles. Sometimes it’s by choice; other times it’s due to bad weather rolling through. Earlier this month, we shared new research on the behavior of the modern worker stuck at home due to Mother Nature. You may have been surprised to see in the data that over 80% of workers felt they were equally, or even more productive, when working from home. However, once you dig into the reasons why they responded this way, that number doesn’t appear so shocking. Check out the word cloud below of the top responses:

People feel they can be more productive at home because they don’t have to deal with daily office distractions and co-worker interruptions. So whether they’ve got the TV on in the background or spent the whole day in their pajamas, they are still cranking away at their tasks — interruption free. And many said they end up working longer hours, because they didn’t have to commute. Being in the office Monday-Friday isn’t necessarily a proof point of productivity anymore. Collaboration with colleagues is without a doubt valuable, but the need to meet in the same room or be in the same office space is no longer a limiting factor to that collaboration. Technology has made it possible to collaborate remotely, so when we get that snowy day, it doesn’t mean a halt in work for our 80% of our survey respondents. The shift towards this trend of productive remote working is just beginning. With constraints on our time, money and quality talent in today’s workforce, far more than just bad weather will soon cause companies to move towards more flexible working hours and spaces. You or your team might want to try WFH a day or two, bad weather or not, and see the impact it has on your productivity and even team morale. I’ll leave you with some quotes of our favorite responses to the question, “Why do you feel more productive when working from home?”

Consider this as an option, if its feasible for you...! Good luck Subsequent to my last post, a lot of time has past, during which the algorithms shown earlier have evolved and have become more effective than ever before. The end result of that can be seen in the performance for February 2016, where both intraday and positional strategy performance for NIFTY and BANKNIFTY futures (Indian Stock Market) is shown. Each point of NIFTY is worth about $1.1 and that of BANKNIFTY about 0.45 $ (US dollars). The significant improvement observed is that these algorithms display incredible consistency. See the LIVETRADING screen where these are implemented. Some of these are also shared with mentees who join the MENTORED TRAINING & TRADING programs.

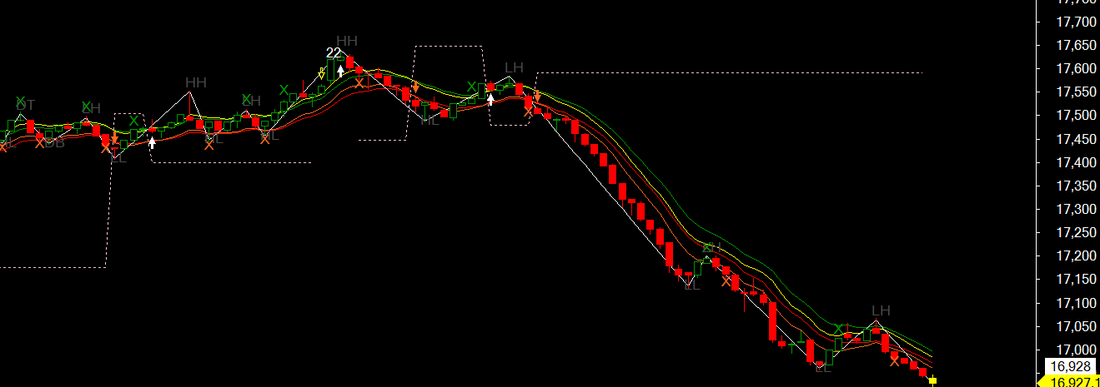

The second last column of the table shown below shows the performance of the different systems following 4 different exit strategies. The last figure in that column is the number of trades..e.g. for serial 4, the monthly profit is 649 points for its first exit strategy with 27 trades on a rapid positional strategy. Details of the other columns are explained in the LIVE TRADING section of the website. Thats what I call this new charting method thats been developed as it adapts to noise based on volatility. The results of the application of the method have been nothing short of spectacular. Its implementation for an Intraday system has given results that are better than any positional system that I have developed over the last 4 years. End result low risk and consistent performance. Its key characteristics are quick response and turnaround to trend changes.

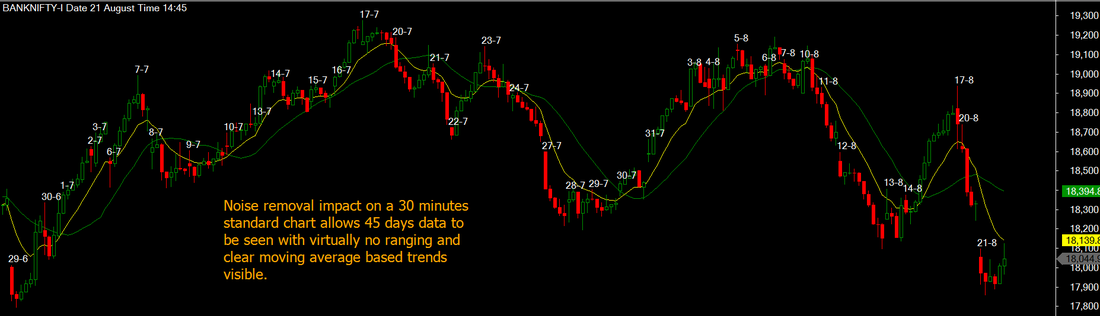

And best part is that the benefit of this has been made available to the LiveScreen traders. A sample of a trading screen shown here below : With ranging periods accounting for 50% of the price movements in most markets, we developed a new way to draw charts without the noise using principles of ignoring inside and some outside bars. No relevant data of highs and lows is ignored in the algorithm during the construction. Very interesting outcomes, which we are beginning to apply to our trading methods. See below a 5 minutes interval chart of BankNifty futures for 2.5 days. On the same period, we applied our algorithm to redraw the charts, and one can now see 14 days of data with extremely clear trends, so much so that the application of a simple moving average crossover becomes practical for trading! 5 minutes plain chart. And now the chart with the algorithm for redrawing applied on the same 5 minutes chart. Observe, how the downtrend from 11th August is captured very easily. The non linear chart that develops compresses 10 days of data on a 5 minute chart. And for comparison the closest bar chart that shows the same chart space is the 30 minutes chart, shown below. That continues to be affected by ranging in that period, while the impact is far less in the algorithmically produced chart above. We are already testing the results of this model on our other standard trading algorithms and will share some results once the tests are completed.

The algorithmic charts for 30 minutes time period (see below) show a complete absence of any ranging and show a period of 45 days versus the 10 shown in the uncompressed chart. Noise removal characteristics are better than any other methods like Point and Figure, Kagi and range bars. Its rare that I ever comment on an external service provider. But since the concept is unique and targeted for better good of households accross India, I decided to share that with my blog readers. While TradeWithMe focuses on trading, Bharosa's focus is on offering access and support to innovative products in ways which no one does. Their first initiative is to catalyse investment in monthly systematic investment plans - SIP - using the Direct NAV route into selected vendor agnostic mutual funds- MF.

Do you know for example, that if you buy any MF product through your broker or investment adviser or wealth management consultant, you are paying upto 1.5% of the fund cost to them as commission and other miscellaneous costs. If however, you invest in a Direct NAV MF, the savings so accrued will lead to a drastic advantage in your savings growth because of a higher NAV. Growth based diversified equity funds SIP's can give returns of 20-25 per annum compounded, usually better than the performance of the index. So the choice of MF is growth based and not dividend return. And secondly, a holding period of 2-3 years is the minimum needed for SIP's to perform. And whats more, your SIP can be as small as Rs 500. Think of the possibilities - you can encourage your domestic help and drivers or assistants to go in for this - financially empowering them or even friends and relatives. 2nd, do you know that MF managed debt funds give you more returns than your savings accounts and most FD's with a 24 hour liquidity cycle time. So idle money should be ideally parked there when not in use and a systematic transfer plan - STF - to transfer the money to your SIP's. Smart thinking eh? Here is where Bharosa.Club comes in. They will facilitate this process for you free of cost for the first 10000 members. And support you thereafter, for any changes that you need. And this is the first such initiative that they have started. The power of numbers of members of the club will enable them to offer many more innovative products that are useful for households. And all that is needed is a missed call to the number : See the poster below for their key messages and try them out by joining just through a missed call to 92433-14010. Add an optional 0 before the number, but with national number portability in place this is not needed in most telecom circles. Go ahead and join - no one will share this lower cost of investing in MF's, not the Wealth Advisors or online investment portals ZipSip, ScripBox and others as they all earn commissions and fees through your investments. Not here!! Continued correction in the markets even as the mainstream Nifty index losses further ground in a correction thats triggered by increasing attention to the US markets. The LiveScreen trading that we have been doing for four months has brought some key messages :

- Trade consistently - even if its a broken record! Thats the only way to make profits. - Assess and accept trade drawdowns. These are part of the game. Sometimes the markets are smarter than your trading systems. Give it the long rope that it needs to get the winning trades. - Your exit strategy can and should contain an exit that crosses your monthly target; at least conservative traders must follow this. - And finally, so long as your trading system gives more profits in winning trades than the losses that it makes in stop lossed trades, you can accept trade success ratios of lesser than 50%. Its a peaceful tension free time now. Automated systems generating trading signals that are tradable and consistent profits. Thats the game! On a side note, today was also an expiry day for derivatives. So we had something like 28 symbols trading combinations, half of them being simply contracts for the next month.. Easy rollover for traders. Usually we trade with no more than 10-15 symbol combinations. Check this out on the performance page today..click here Non discretionary trading was the key objective I had set for myself 4 years ago when I ventured seriously into full time trading. Now that its been achieved with a wonderful platform that is being used by our customers, there is no looking back now. The results are excellent, coupled with an emotionless and disciplined approach with very granular metrics which help our customers analyse the trades data and make their own exit strategies.

From a trading perspective, this approach has helped us to explore new approaches to trading, hitherto unexplored. If you havent already experienced the success of non discretionary trading, try it now. Come TradeWithMe :) ... |

AuthorAbnash Singh, Am a Trader helping small traders to realize their dreams. Archives

October 2017

Categories

All

|

|

Want more information ? Get in touch with us through the contact form : (click here)

|

|

RSS Feed

RSS Feed