| TradeWithMe |

MY STYLE - BLOG

|

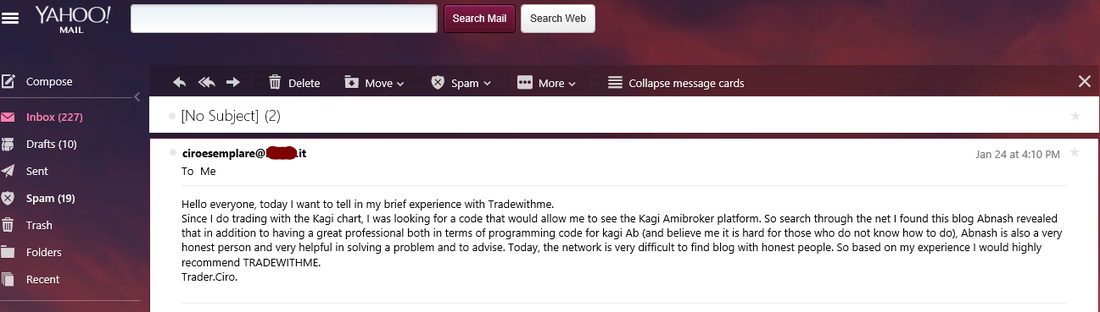

This was a chance encounter. A trader from Italy who only traded on Kagi charts, was not happy with what was available on any commercial platform and got in touch with me a few months ago. After developing a chart that he liked and having used for the last 3 months, he sent this feedback, which certainly warms ones heart. Unedited, a screen shot from my Yahoo mail box. (click the image to see a larger view).

1 Comment

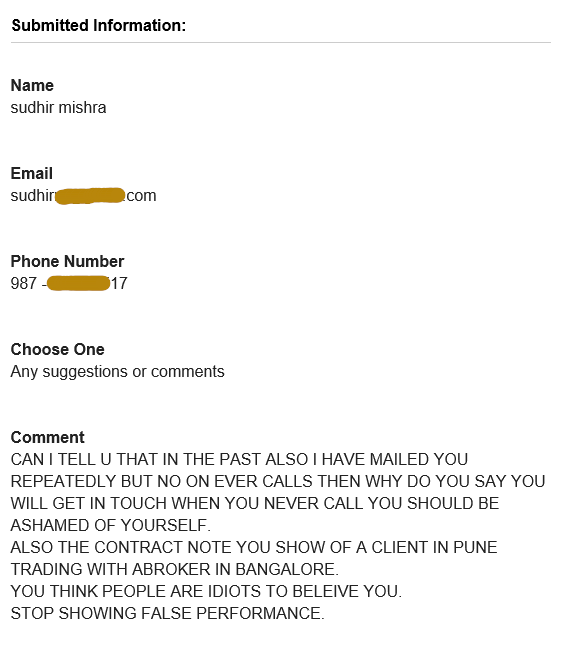

We get our share of brick bats, and this is the first such one in three years. While the first part of the complaint is justified, and is a technical failure of our mail engine, and we have tried to make amends by offering a free one month subscription to any of our offerings, the second is the one, which forced us to highlight the comment here.

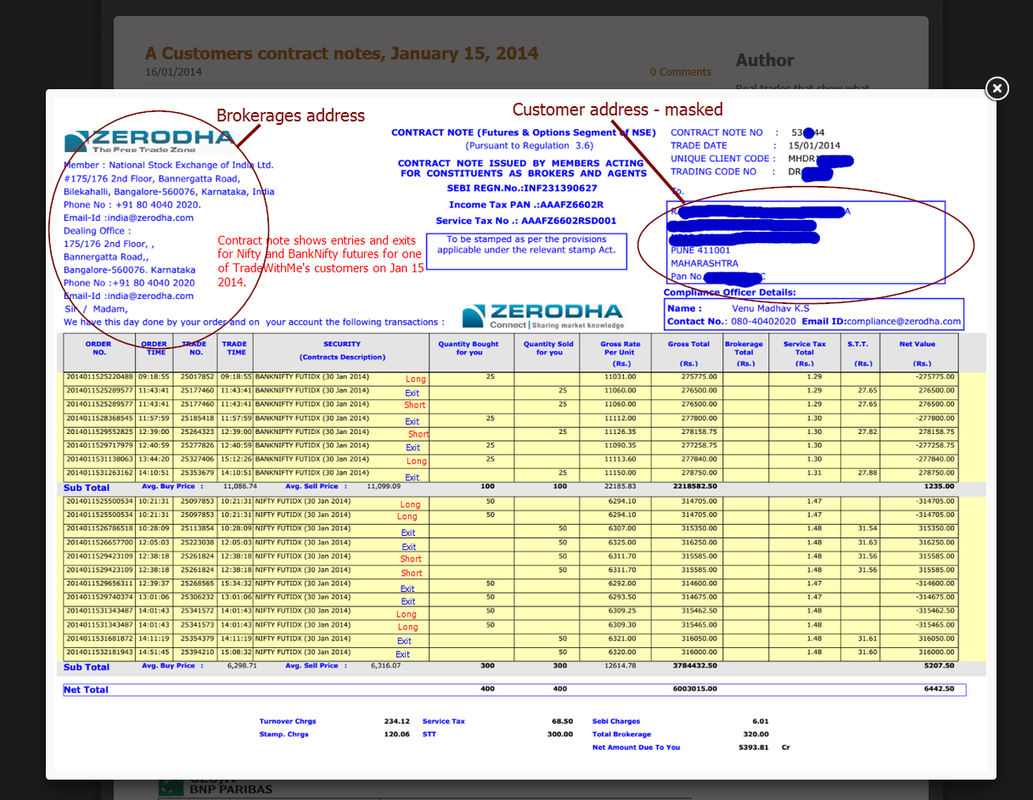

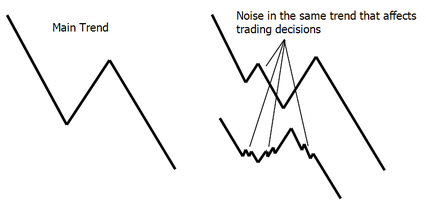

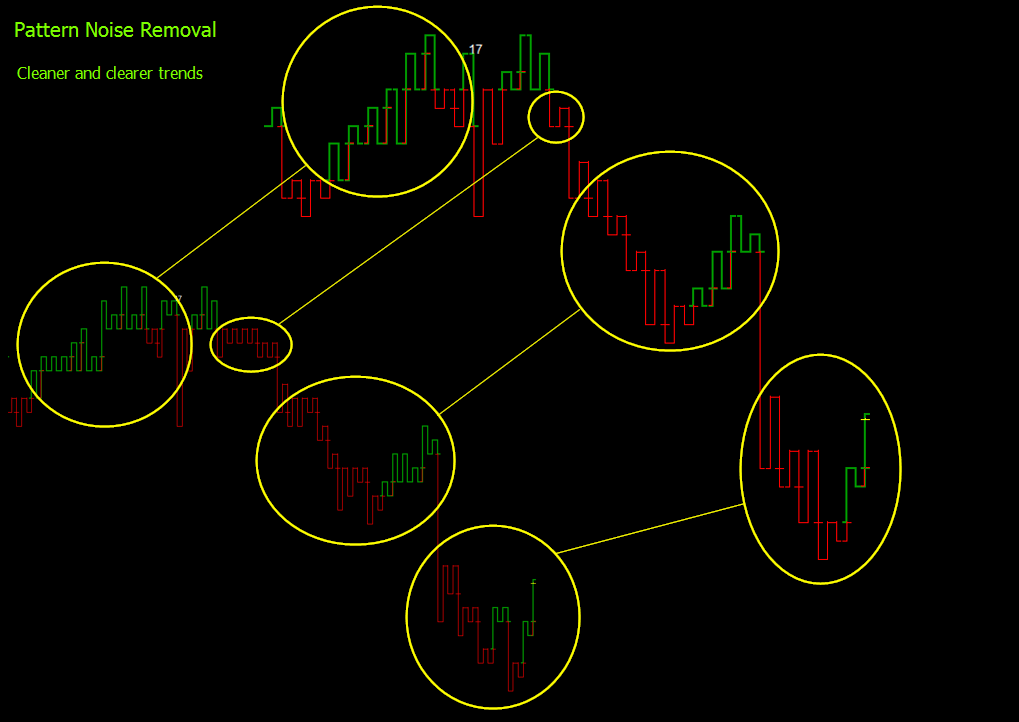

The customer alleges that we are putting false information regarding contract notes on the website. I would like to highlight that he is ill informed on the format of a contract note which shows the office address of the brokerage firm in the header and the customers detail as a recipient of the contract note. For convenience the contract note is highlighted here so that there is no possible confusion in any ones mind. Zerodha is a reputed brokerage with a good online presence. It comes as a surprise and also a painful shocker, when someone makes such comments. But then, I guess, we have to be ready for such reactions, when we are being open and transparent. One of the major challenges that any technical trader faces is the removal of noise from price charts as these obscure and camouflage the underlying trend to force trades that fail. The current methods to handle noise vary from basic to sophisticated, but still do not help significantly especially in ranging periods where a smaller period noise interferes with the trend patterns. An example of smaller period noise is swing patterns within a larger trend as shown below, which is a very common occurence in markets: In the above examples the noise patterns are not exaggerated as they are in real markets. Some of the techniques that are used to remove noise are averaging price, using trend identifying methods like Heiken-Ashi and other similar approaches. Other alternatives are to use time-less charting methods like Point and Figure, Renko and Kagi or other proprietary methods. However, these methods do not handle lower order noise as shown above effectively, without significantly increasing trading risk.

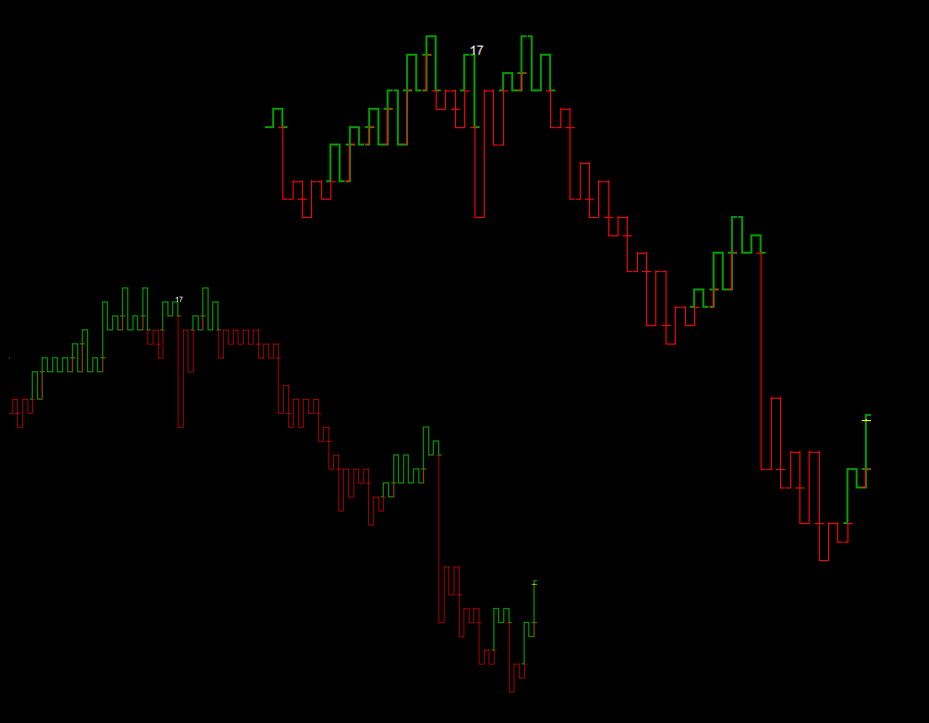

Another method to handle noise is to remove the spurious noisy patterns from the underlying data, before drawing the charts. This can lead to amazing clarity in the trends as is demonstrated in a noise removal technique used in a Kagi chart, as an example below in the two sets of images. The upper chart represents the same data but shows the underlying trend without any of the lower order noise. Another research innovation at TradeWithMe at work. Some times you get pleasantly surprised with the most unusual comments in the trading social network. I was busy trading on January 15 and I get few comments during the day, which made me feel that the journey that I set out (helping traders meet their financial objectives) on is meeting its objectives. Here are the comments from a couple of traders, received on my messenger (names masked) which simply got me a smile and cheer in an otherwise bright day :) :

Quote Comment 1: dipxxz: i am not able to understand...i m watching a dream; is it real...sirji great sirji abnash: :) dipxxz: after joined with you sirji...i feel that mkt is not moving itself....you are operating....:) And a rejoinder from one of our traders : "bxxxxtrader : :)) i wonder what he'll say once he starts learning" Comment 2: belphexxxxxearch: ok belphexxxxxearch: long worked again sir :-) belphexxxxxearch: thnx abnash: Yes... abnash: :) belphexxxxxearch: u r a genius :-) Comment 3: Rxxxxxxa : Paisa vasool for us also :D (translation : 100% return on investment) Comment 4: (received on the blog comment - "Consistency In Trading", partly paraphrased for English corrections) Commodity Tips : I would want to thank for that efforts you've invested in this web page. I am hopeful that similar high-grade web posts are forthcoming in the future. Clothed in genuineness your imaginative writing skills has motivated me to achieve my own blog today. In fact your blogging is actually spreading its wings fast. You invent a sunny paradigm of it. Unquote I have never received such comments on my work, and I hope and wish that these and other traders who use the information on the website or tradewithme, get inspired and do well. |

AuthorAbnash Singh, Am a Trader helping small traders to realize their dreams. Archives

October 2017

Categories

All

|

|

Want more information ? Get in touch with us through the contact form : (click here)

|

|

RSS Feed

RSS Feed