| TradeWithMe |

MY STYLE - BLOG

|

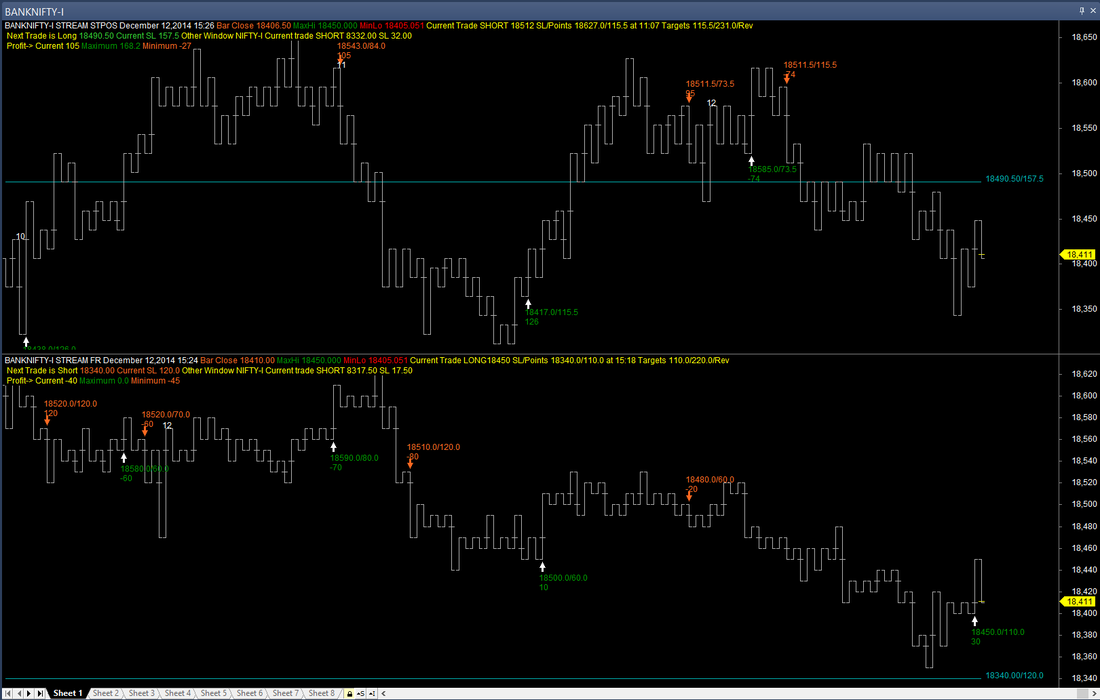

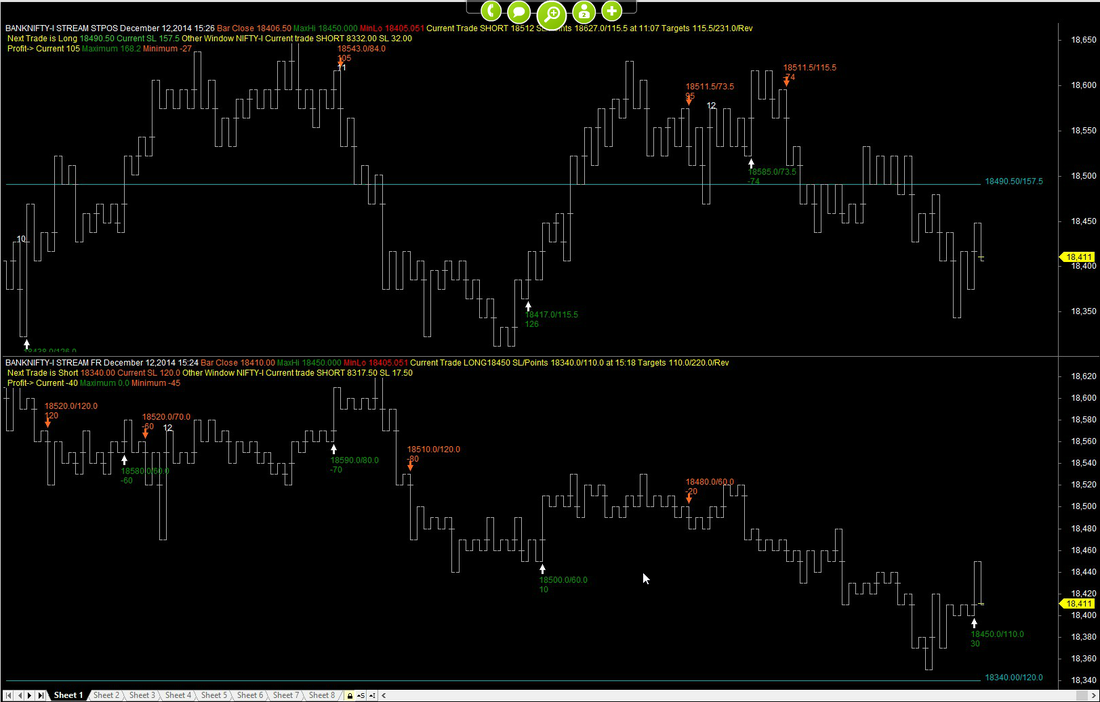

With Non discetionary or automated signals in place, the next logical step was to broadcast these signals to our customers and thats exactly what we have done. But unlike fuzzy low resolution, our trade screen broadcasts with trading signals for Nifty and BankNifty Futures are broadcast at high resolution with surprisingly low bandwidth requirements. Shown below is the original and broadcast screen on a PC. The broadcast which is currently under trials can be received on any PC, Mac or mobile device. The current system generates about 200 Nifty points and 700 BankNifty points after all costs with a trading success rate of 45-50% with zero intervention based on 6 months backtests.

The original and broadcast screens are shown below. Anyone wanting a trial access to the broadcast is welcome to contact for access on any market day. The screens show intraday and positional trades for each index. Click on any image for a larger view. An interesting feature of these broadcasts is an automatic switch of the screen from Nifty to BankNifty every minute or so with the details of the current trade on the swapped out window shown on the current window that is showing the details of the other index.

1 Comment

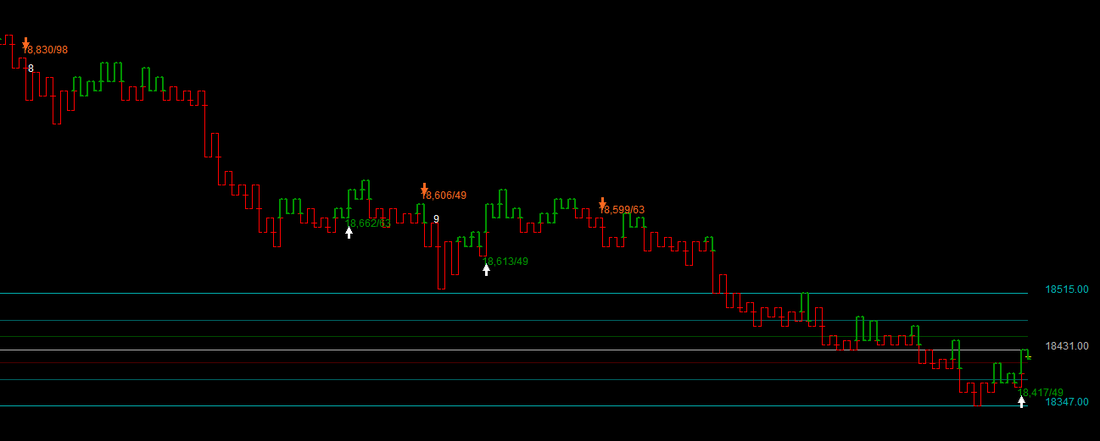

Finally after several years of working on discretionary trading, I have been able to design a system that is completely non discretionary. The motivation for this came from the deteriorating quality of trades on Nifty Futures which were caused by excess volatility where emotions tend to make systems go haywire. See todays trades on BankNifty futures through this system, the same one that we use also in mentoring and training traders through our mentored trading program.(click to expand picture). The Kagi representation is just one of the many ways that one can look at price movement and we chose that for this illustration. Otherwise, we could use time bars, point and figure, renko or anything else. The price movement basis is all that really matters. The trades seem to just flow with the trend. Backtests give success rates ranging from 45% to 70% based on the parameter selection. One revealing observation is that reversal trades - those that remain active till the price reverses trend are the most successful trades and beat risk based as well as fixed target trades in all time frames. One also needs to be sensitive to the natural frequency of the wave movement of each instrument to some extent as that affects the success ration.

|

AuthorAbnash Singh, Am a Trader helping small traders to realize their dreams. Archives

October 2017

Categories

All

|

|

Want more information ? Get in touch with us through the contact form : (click here)

|

|

RSS Feed

RSS Feed