| TradeWithMe |

9. Build your trading strategy - The Psychology and Approach

This section draws on the structure by Larry Levin, a successful Chicago S&P trader and his work "The Secrets of Emotion free trading". I have added my own ideas and tools which can help the reader to apply some of them more effectively. Readers are advised to also read the original e-book and visit Larry's website Trading advantage.

A technical trading system is only part of the whole success behind trading. Yes, you can be successful, by just trading with technical indicators, but you need to have a sound trading strategy to succeed. The key elements of that strategy are:

- Define a goal for yourself, and stick to it.

- Your trading focus, based on your goals and your trading preference - intraday, semi-positional or long term positional

- Risk and Money Management

- Your trading system

Why are these points important? Here is an imaginary story.

Ram is a business man. He has a successful furnitures trading business and he reads in the newspapers about the stock traders who made their millions in the markets. One day, he decides to sell his furniture business and start trading. He reads about technical indicators and the methods that Gurus talk on the blogs. And he feels confident that he can trade in the futures markets.

Shyam works with a broker. He started as a call agent receiving orders from clients that he placed on the market terminals. Often he would go to the stock exchange in the course of business and meet traders who were successful. He has a dream to become a successful trader on his own right. He tried to get as much knowledge about trading techniques and what worked best from his peers. He started getting confident and thought he could be successful at trading.

Ram and Shyam leave their current environments and start trading.

On the first day of trading, Ram, started trading on Nifty futures. His indicators showed that the trend was positive. And his first trade made 50 points in an hour. Thats good! though Ram. Rs 2500.. This is simple. The next trade, he re-entered the successful long trade at the end, thinking, the market had more momentum, but unfortunately, the market went down 75 points and his stop loss hit at 20 points. Ram was disappointed at the end of the day. Next day, he started trading again. The trend line shows that the market is down! he says before the start of the market. And he shorts Nifty at market open, only to see Nifty gallop away in the opposite direction some 25 points and then stay there. Ok, something must be wrong with my initial assumption. Lets average out the price, and adds another short order at the higher level. After another forty minutes, the market suddenly moves 50 points up because of some positive political development and his losses have mounted. He liquidates his position and goes back to the drawing board.

Next day, he decides that strict stop losses and no averaging of prices - thats his new rule. First trade 30 points profit. Next trade 20 points profit. Ah, this is better. 3rd trade, Stop loss of 15 points gets hit. This is not so good. Says he. But overall profit for the day.

The 3rd day, he hits stop losses in the first two trades. Getting impatient, he thinks, that something is wrong with his stop loss levels. He places new orders and the trade starts to go against him. He moves the stop loss point further away..30 points and hits. So next trade, he removes the stop loss altogether. And as you guessed it, the trade goes against him.

In the evening, he discusses whats happening with his wife - that futures trading is not for him, and decides to stop trading and back to the furniture business.

How about Shyam? A very confident Shyam, starts trading with the benefit of the advice given to him by his well wishers - respect the rules, they said. So he has a well layed out plan on how he is going to trade and has a trade record sheet. Like Ram, the first few trades work for him. Then he sees a stop loss being hit and the trade again going in his original direction. In the following trade, he increases the stop loss, and that again gets hit. He has had 3 stop loss trades and 5% of his trading capital has eroded. He decides to go back to the drawing board. He talks to some of his successful peers. And they tell him some mantra's.

And we talk about some of them in the subsections below.

A technical trading system is only part of the whole success behind trading. Yes, you can be successful, by just trading with technical indicators, but you need to have a sound trading strategy to succeed. The key elements of that strategy are:

- Define a goal for yourself, and stick to it.

- Your trading focus, based on your goals and your trading preference - intraday, semi-positional or long term positional

- Risk and Money Management

- Your trading system

Why are these points important? Here is an imaginary story.

Ram is a business man. He has a successful furnitures trading business and he reads in the newspapers about the stock traders who made their millions in the markets. One day, he decides to sell his furniture business and start trading. He reads about technical indicators and the methods that Gurus talk on the blogs. And he feels confident that he can trade in the futures markets.

Shyam works with a broker. He started as a call agent receiving orders from clients that he placed on the market terminals. Often he would go to the stock exchange in the course of business and meet traders who were successful. He has a dream to become a successful trader on his own right. He tried to get as much knowledge about trading techniques and what worked best from his peers. He started getting confident and thought he could be successful at trading.

Ram and Shyam leave their current environments and start trading.

On the first day of trading, Ram, started trading on Nifty futures. His indicators showed that the trend was positive. And his first trade made 50 points in an hour. Thats good! though Ram. Rs 2500.. This is simple. The next trade, he re-entered the successful long trade at the end, thinking, the market had more momentum, but unfortunately, the market went down 75 points and his stop loss hit at 20 points. Ram was disappointed at the end of the day. Next day, he started trading again. The trend line shows that the market is down! he says before the start of the market. And he shorts Nifty at market open, only to see Nifty gallop away in the opposite direction some 25 points and then stay there. Ok, something must be wrong with my initial assumption. Lets average out the price, and adds another short order at the higher level. After another forty minutes, the market suddenly moves 50 points up because of some positive political development and his losses have mounted. He liquidates his position and goes back to the drawing board.

Next day, he decides that strict stop losses and no averaging of prices - thats his new rule. First trade 30 points profit. Next trade 20 points profit. Ah, this is better. 3rd trade, Stop loss of 15 points gets hit. This is not so good. Says he. But overall profit for the day.

The 3rd day, he hits stop losses in the first two trades. Getting impatient, he thinks, that something is wrong with his stop loss levels. He places new orders and the trade starts to go against him. He moves the stop loss point further away..30 points and hits. So next trade, he removes the stop loss altogether. And as you guessed it, the trade goes against him.

In the evening, he discusses whats happening with his wife - that futures trading is not for him, and decides to stop trading and back to the furniture business.

How about Shyam? A very confident Shyam, starts trading with the benefit of the advice given to him by his well wishers - respect the rules, they said. So he has a well layed out plan on how he is going to trade and has a trade record sheet. Like Ram, the first few trades work for him. Then he sees a stop loss being hit and the trade again going in his original direction. In the following trade, he increases the stop loss, and that again gets hit. He has had 3 stop loss trades and 5% of his trading capital has eroded. He decides to go back to the drawing board. He talks to some of his successful peers. And they tell him some mantra's.

And we talk about some of them in the subsections below.

9.1 Your Trading Goals

Its important to get your perspective clear.

You may have a goal clearly in mind, but it must have three important characteristics:

1) Your goal must be realistic.

2) Your goal must be attainable.

3) Your goal must be measurable.If you want to be a successful trader, the first thing that you need to do is to set your trading goals.

In specific, the goal cannot be winning every day. It should be defined in objective terms. Examples:

- Trading will be my livelihood and I will earn Rs 50000 per month.

- I want to earn Rs 500 a day.

- I am happy earning Rs 10-20000 a month. And since I am not dependent on trading, it wont kill me, if I dont trade everyday.

Now these are specific goals. They will be realistic, if these are achievable with reasonable probability with the capital that you deploy. And of course these are measurable, since you have defined a money value for each one of them.

Next based on your goals, you need to determine the means to the goals. Will you day trade or position trade - short or long term? If you want to spend all your time in trading, experiment with day trading or short term position trading. If you are more like an investor and see returns based on steady trends, go for long term position trading.

Are you a day trader or positional trader. The implications are different in terms of trading styles.

If you are a day trader, you need to have your trading setup and margin arrangements finely tuned. You need to have access to real time data sources and preferably views of price charts. You also need to have competitive and low cost trading platforms. Brokers can be your friends but they can also be sharks while you trade. If you have a high transaction cost, your broker will be laughing all the way to the bank if you do high volume intraday trading.

You need to have a good trading platform. Good means, it must have the look, feel and responsiveness of a brokers terminal. Do not use web based platforms as the response time is usually slower than PC software based platforms. When you punch in your order, the response must be within milliseconds so that you do not miss out on trading opportunities. The software must show you a record of time stamped transactions that you do in a day, your pending or unexecuted orders and the trades that you did. It should show you your current holdings, and the profitability of your intraday positions with mark to market (MTM) profits.

If you are a position trader, you may want the ability to place post or pre market order in addition to the above. Your delivery brokerage costs must be low. You may want to understand hedging principles so that overnight positions risks can be managed.

You may have a goal clearly in mind, but it must have three important characteristics:

1) Your goal must be realistic.

2) Your goal must be attainable.

3) Your goal must be measurable.If you want to be a successful trader, the first thing that you need to do is to set your trading goals.

In specific, the goal cannot be winning every day. It should be defined in objective terms. Examples:

- Trading will be my livelihood and I will earn Rs 50000 per month.

- I want to earn Rs 500 a day.

- I am happy earning Rs 10-20000 a month. And since I am not dependent on trading, it wont kill me, if I dont trade everyday.

Now these are specific goals. They will be realistic, if these are achievable with reasonable probability with the capital that you deploy. And of course these are measurable, since you have defined a money value for each one of them.

Next based on your goals, you need to determine the means to the goals. Will you day trade or position trade - short or long term? If you want to spend all your time in trading, experiment with day trading or short term position trading. If you are more like an investor and see returns based on steady trends, go for long term position trading.

Are you a day trader or positional trader. The implications are different in terms of trading styles.

If you are a day trader, you need to have your trading setup and margin arrangements finely tuned. You need to have access to real time data sources and preferably views of price charts. You also need to have competitive and low cost trading platforms. Brokers can be your friends but they can also be sharks while you trade. If you have a high transaction cost, your broker will be laughing all the way to the bank if you do high volume intraday trading.

You need to have a good trading platform. Good means, it must have the look, feel and responsiveness of a brokers terminal. Do not use web based platforms as the response time is usually slower than PC software based platforms. When you punch in your order, the response must be within milliseconds so that you do not miss out on trading opportunities. The software must show you a record of time stamped transactions that you do in a day, your pending or unexecuted orders and the trades that you did. It should show you your current holdings, and the profitability of your intraday positions with mark to market (MTM) profits.

If you are a position trader, you may want the ability to place post or pre market order in addition to the above. Your delivery brokerage costs must be low. You may want to understand hedging principles so that overnight positions risks can be managed.

9.2 Envision success!

This is perhaps one of the most important message if this section and an important message even in Larry Levins "Secrets of Emotion Free Trading", which has been a good reference for me.

Just as important as setting specific goals, you must visualize yourself successfully reaching those goals each and everyday. If you can’t see yourself in your mind’s eye as a success, there is no chance you will become successful. It just won’t happen!”

Not only must you have a goal and a plan to execute on the goals for trading, you need to think of your successful future and imagine how it is! Envision it.

See where you are today and the gap between the future and the present.

Break that gap into achievable milestones, like that in a project plan, like building a house. You need land, you need money, you need an architect to design it for you, you need to have the resources and time to manage and monitor its progress.

The same things are required to fill the gap between your present and future envisioned successful environment.

Think of what people around you will say, about how you achieved those goals.

What are the difficulties that you had to surmount to overcome before you became successful?

What did they see you doing everyday?

What will be the process and approach that you will follow to in your trading style?

Are you going to trade on your own? or you will take the help of a mentor or you will subscribe to a successful traders services?

Give some of these points more than a passing thought and build your plan to get through the milestones that you have set for yourself.

For example, you may say to yourself, that you want to see Rs 2500 credited into your bank at the end of each week as a goal for the very short term and this is what you will do:

- I will paper trade my trading method for a week or a month and see whether it delivers Rs 2500 per week?

- Then I will do real trades for a week and evaluate the results.

- Did I achieve Rs 2500 at the end of the week? If not, why?

- Analyse, paper trade, real trades, evaluate...and repeat this cycle till your goals are met and then set a new goal with a whole new thinking behind to to take the progress to the next level.

Shyam followed the above steps and he did start making Rs 2500 per week. But his evaluation showed that this trading system was not giving consistent results. So for the next step, he said, he would use a combination of a subscription service and paper trade his system till he ironed out the issues. However, he was not happy with the results of the service provider who gave him tips, as he had not evaluated the provider with proper due diligence.

Just as important as setting specific goals, you must visualize yourself successfully reaching those goals each and everyday. If you can’t see yourself in your mind’s eye as a success, there is no chance you will become successful. It just won’t happen!”

Not only must you have a goal and a plan to execute on the goals for trading, you need to think of your successful future and imagine how it is! Envision it.

See where you are today and the gap between the future and the present.

Break that gap into achievable milestones, like that in a project plan, like building a house. You need land, you need money, you need an architect to design it for you, you need to have the resources and time to manage and monitor its progress.

The same things are required to fill the gap between your present and future envisioned successful environment.

Think of what people around you will say, about how you achieved those goals.

What are the difficulties that you had to surmount to overcome before you became successful?

What did they see you doing everyday?

What will be the process and approach that you will follow to in your trading style?

Are you going to trade on your own? or you will take the help of a mentor or you will subscribe to a successful traders services?

Give some of these points more than a passing thought and build your plan to get through the milestones that you have set for yourself.

For example, you may say to yourself, that you want to see Rs 2500 credited into your bank at the end of each week as a goal for the very short term and this is what you will do:

- I will paper trade my trading method for a week or a month and see whether it delivers Rs 2500 per week?

- Then I will do real trades for a week and evaluate the results.

- Did I achieve Rs 2500 at the end of the week? If not, why?

- Analyse, paper trade, real trades, evaluate...and repeat this cycle till your goals are met and then set a new goal with a whole new thinking behind to to take the progress to the next level.

Shyam followed the above steps and he did start making Rs 2500 per week. But his evaluation showed that this trading system was not giving consistent results. So for the next step, he said, he would use a combination of a subscription service and paper trade his system till he ironed out the issues. However, he was not happy with the results of the service provider who gave him tips, as he had not evaluated the provider with proper due diligence.

9.3 Whats different in futures or stock trading versus other professions?

We have envisioned our future and we have made a plan that we are learning to execute. What about the emotions and thoughts behind everything around trading?

Its important that you are always in control!!! In control of what? You cant control the market. So what control...... confusing?

As Larry Levin says, there is more freedom in stocks and futures trading than most other businesses. You can do whatever you want, pretty much at any time, what with the leveraged margins that brokers offer and the numerous "experts" giving online and broadcast commentary on everything that you can possibly trade. If you want to drive, for example, you have the control to put the key in the ignition slot and turn it and the switch gears and start rolling. In your normal corporate job, you are working a well controlled environment where if not you, your bosses and peers have some control on the factors that affect you.

In the stock markets, the markets dont wait for you. They are there everyday, moving in one direction or the other or sometimes direction less. You can decide to trade or not.. Thats one control you have. You can decide when to enter and when to exit. Thats the maximum you can do. You cant influence the direction of the market, unless you are Mukesh Ambani and have billions in your bank account to speculate. (I guess, he wouldnt do that anyway with his shrewd business sense). For sure, you cannot control any of the markets behaviour. You have very limited choices of what you can really do.

If you cant control the market what can you control? Well, the simple answer, control yourself!!

So you can only time your entries and exits and the amount of money that you play with. Thats a pretty small control that you have. That means that the only thing that you can do is to time your actions as best as you can and exercise control thats in your best interest as far as these actions are concerned. You would do things in your best interest by timing your actions like :

- Not risking more than 3% of capital as loss in any given trade.

- Exiting profitable trades, once a target profit is made. And not running after the profits (unless you are using trailing stop losses).

- Always working with stop losses so that you dont lose large amounts of capital.

Think of all of the actions that can be in your best interest, always. Never let this focus out of mind.

Shyam is back in the market with renewed vigor and a newly tested and paper traded algorithm. His next three trades all hit stop losses. And he is again stuck with losses. He decides that he will not trade anymore that day as 3% of his capital has eroded. He decides to seek expert help on a trading algorithm that will give at least 50-70 % success.

He goes back to Anuj, an expert trader in a leading brokerage houses analytics team. Anuj gives him a mantra, which as Larry Levin says:

“A person with good self-discipline but a poor trading method will outperform a person with poor self-discipline but the best trading method currently available.”

In fact, an example of that is given in the next section, how you can trade by Coin Tossing!

So while you act in your best interest, work on building a self discipline.

We all want those huge winning trades. But one thing we must all remember is we can’t control what the market will do, so we must be prepared for whatever it does do. Thus, if we have a good winning run of 100 points when our objective was 75, we must gracefully exit before these profits evaporate even if that means missing out on a big winner. Thats the discipline that we need!

Shyam decides to think about this.

Its important that you are always in control!!! In control of what? You cant control the market. So what control...... confusing?

As Larry Levin says, there is more freedom in stocks and futures trading than most other businesses. You can do whatever you want, pretty much at any time, what with the leveraged margins that brokers offer and the numerous "experts" giving online and broadcast commentary on everything that you can possibly trade. If you want to drive, for example, you have the control to put the key in the ignition slot and turn it and the switch gears and start rolling. In your normal corporate job, you are working a well controlled environment where if not you, your bosses and peers have some control on the factors that affect you.

In the stock markets, the markets dont wait for you. They are there everyday, moving in one direction or the other or sometimes direction less. You can decide to trade or not.. Thats one control you have. You can decide when to enter and when to exit. Thats the maximum you can do. You cant influence the direction of the market, unless you are Mukesh Ambani and have billions in your bank account to speculate. (I guess, he wouldnt do that anyway with his shrewd business sense). For sure, you cannot control any of the markets behaviour. You have very limited choices of what you can really do.

If you cant control the market what can you control? Well, the simple answer, control yourself!!

So you can only time your entries and exits and the amount of money that you play with. Thats a pretty small control that you have. That means that the only thing that you can do is to time your actions as best as you can and exercise control thats in your best interest as far as these actions are concerned. You would do things in your best interest by timing your actions like :

- Not risking more than 3% of capital as loss in any given trade.

- Exiting profitable trades, once a target profit is made. And not running after the profits (unless you are using trailing stop losses).

- Always working with stop losses so that you dont lose large amounts of capital.

Think of all of the actions that can be in your best interest, always. Never let this focus out of mind.

Shyam is back in the market with renewed vigor and a newly tested and paper traded algorithm. His next three trades all hit stop losses. And he is again stuck with losses. He decides that he will not trade anymore that day as 3% of his capital has eroded. He decides to seek expert help on a trading algorithm that will give at least 50-70 % success.

He goes back to Anuj, an expert trader in a leading brokerage houses analytics team. Anuj gives him a mantra, which as Larry Levin says:

“A person with good self-discipline but a poor trading method will outperform a person with poor self-discipline but the best trading method currently available.”

In fact, an example of that is given in the next section, how you can trade by Coin Tossing!

So while you act in your best interest, work on building a self discipline.

We all want those huge winning trades. But one thing we must all remember is we can’t control what the market will do, so we must be prepared for whatever it does do. Thus, if we have a good winning run of 100 points when our objective was 75, we must gracefully exit before these profits evaporate even if that means missing out on a big winner. Thats the discipline that we need!

Shyam decides to think about this.

9.4 Acting in your best interest - Risk and Money Management

What are your risking normally - its your hard earned capital. If you trade without any basic money management or risk management plan, you will surely lose all your capital. Here is a framework to set things in order, which can save you a lot of tension, emotional drainage and fear of the market.

Fundamental - DO NOT TRADE IF YOU DONT HAVE FOLLOWING TWO POINTS MANAGED:

1. A trading system (even if these are tips) which doesnt generate better than 60% winning trades.(and you will see why shortly).

2. You dont have a written money management plan, which you use, everyday.

Here is an example of the factors involved in money management. If you have a capital of 100000, decide how much you can risk to lose in a day,week and a month. Example, we say 0.5%-2% per day. This translates upto 40% per month, which is unacceptable, so you have a weekly and monthly cap as well.

Say 5% for the week and 10% for the month.

So to avoid our capital disappearing into smoke, the first rules for trading that evolve are:

If any day our loss exceeds 2%, (Rs 2000) stop we trading for the rest of the day.

Any week, our loss exceeds 5% (Rs 5000) cumulative, stop trading for the rest of the week.

Any month, your loss exceeds 10%, (Rs 10000) stop trading further.

At each of the stops, in case these are hit, we should review the trading methodology.

Unless our trading system delivers 60-70% winning trades on a consistent basis (for discretionary trading and 40-55% for non discretionary trading), first on paper trades and then in the real trading environment, we dont trade again. Money that you dont trade is money saved. So on every day/week and month, use the win %age and the loss amounts as barriers for any further trades. And if you dont cross them, step back, review and fix the basic issues. If you do cross, the barriers, you are cruising to success.

If the win trade ratio of your trading system is not >60% the absolute minimum (40% for non discretionary trading), then your trading method is faulty and you are gambling. Review the method and fix it first, as suggested above.

Now, a little deeper into the daily loss of 0.5-2%. If your risk is say 2% of capital in a day. Say for Nifty futures margin is Rs 40000. The risk amount per day is 2% or Rs 800. So if you do 3 trades in Nifty in a day or lets say 4, then you cannot risk more than Rs. 200 loss per trade or 4 points (lot size of 50). Your reward or profit per trade needs to be at least 2:1 times this risk or Rs 400 so that even if your success ratio is 50%, 2 winning and 2 losing trades you lose Rs 200 per trade = Rs 400 total, and gain Rs 400 per trade = Rs 800, with a net gain of Rs 400, you still are a winner. Target therefore for higher risk reward ratios of 3:1, if you can.

See the linkage of the winning trade %age of greater than 60% instead of 50% above and a modest risk reward ratio of 2:1. If these are met consistently, you are winning consistently and making money.

So here are your trading rules:

Decide your daily,weekly and monthly loss risk %ages of your capital.

Example Capital 100000, risk %age per day 2%= Rs 2000, Weekly 8% = Rs 8000 and Monthly 15% = Rs 15000.

This means you cannot lose more than Rs 2000 in all transactions per day, Rs 8000 in all transactions for the week and Rs 15000 for all transactions for the month.

Within each day, week and month, follow the following methodology.

End of each day/week/month:

Compute the trade win ratio = Your trades that were proftable after brokerage/(total trades that you did).

So if you did 8 trades in a day and 5 were profitable, your trade win ratio = 5/8 = 61% approx.

Analyse your winning trades. If your daily risk capital is Rs 2000 and if you allocated Rs 1600 to the risk for your trades, say at Rs 200 for each trade (it can vary for different scrips), did you win 2:1 = Rs 1600*2 = Rs 3200? The individual trades ratios are unimportant, so long as the focus is clear. If the profit number is not Rs 3200, review what went wrong, and confirm whether it was a major or minor issue with your system.

Now at the end of the day/week/month, do the above nos tie up?

Win ratio consistently > 60%

Profit for day > allocated and utilised risk capital - if it was Rs 1600 for a particular day - your profit must be Rs 3200.

Profit for week > allocated and utilised risk capital used that week. Say Rs 4000 - Your weeks profit must be Rs 8000 at least.

Profit for month > Allocated and utilised risk capital say Rs 12000 - Your profits for the month must be Rs 24000 or more..

Stop, review and fix issues, whenever, these benchmarks are not achieved. Paper trade when you strart trading again, to ensure that you are on the right track. You NEVER lost money by not trading

Our intrepid trader Shyam, works out his risk management plan and feels that he is beginning to see light at the end of the tunnel. His earnings are now steady. He thinks about the factors that got him there. And here are some of them :

Fundamental - DO NOT TRADE IF YOU DONT HAVE FOLLOWING TWO POINTS MANAGED:

1. A trading system (even if these are tips) which doesnt generate better than 60% winning trades.(and you will see why shortly).

2. You dont have a written money management plan, which you use, everyday.

Here is an example of the factors involved in money management. If you have a capital of 100000, decide how much you can risk to lose in a day,week and a month. Example, we say 0.5%-2% per day. This translates upto 40% per month, which is unacceptable, so you have a weekly and monthly cap as well.

Say 5% for the week and 10% for the month.

So to avoid our capital disappearing into smoke, the first rules for trading that evolve are:

If any day our loss exceeds 2%, (Rs 2000) stop we trading for the rest of the day.

Any week, our loss exceeds 5% (Rs 5000) cumulative, stop trading for the rest of the week.

Any month, your loss exceeds 10%, (Rs 10000) stop trading further.

At each of the stops, in case these are hit, we should review the trading methodology.

Unless our trading system delivers 60-70% winning trades on a consistent basis (for discretionary trading and 40-55% for non discretionary trading), first on paper trades and then in the real trading environment, we dont trade again. Money that you dont trade is money saved. So on every day/week and month, use the win %age and the loss amounts as barriers for any further trades. And if you dont cross them, step back, review and fix the basic issues. If you do cross, the barriers, you are cruising to success.

If the win trade ratio of your trading system is not >60% the absolute minimum (40% for non discretionary trading), then your trading method is faulty and you are gambling. Review the method and fix it first, as suggested above.

Now, a little deeper into the daily loss of 0.5-2%. If your risk is say 2% of capital in a day. Say for Nifty futures margin is Rs 40000. The risk amount per day is 2% or Rs 800. So if you do 3 trades in Nifty in a day or lets say 4, then you cannot risk more than Rs. 200 loss per trade or 4 points (lot size of 50). Your reward or profit per trade needs to be at least 2:1 times this risk or Rs 400 so that even if your success ratio is 50%, 2 winning and 2 losing trades you lose Rs 200 per trade = Rs 400 total, and gain Rs 400 per trade = Rs 800, with a net gain of Rs 400, you still are a winner. Target therefore for higher risk reward ratios of 3:1, if you can.

See the linkage of the winning trade %age of greater than 60% instead of 50% above and a modest risk reward ratio of 2:1. If these are met consistently, you are winning consistently and making money.

So here are your trading rules:

Decide your daily,weekly and monthly loss risk %ages of your capital.

Example Capital 100000, risk %age per day 2%= Rs 2000, Weekly 8% = Rs 8000 and Monthly 15% = Rs 15000.

This means you cannot lose more than Rs 2000 in all transactions per day, Rs 8000 in all transactions for the week and Rs 15000 for all transactions for the month.

Within each day, week and month, follow the following methodology.

End of each day/week/month:

Compute the trade win ratio = Your trades that were proftable after brokerage/(total trades that you did).

So if you did 8 trades in a day and 5 were profitable, your trade win ratio = 5/8 = 61% approx.

Analyse your winning trades. If your daily risk capital is Rs 2000 and if you allocated Rs 1600 to the risk for your trades, say at Rs 200 for each trade (it can vary for different scrips), did you win 2:1 = Rs 1600*2 = Rs 3200? The individual trades ratios are unimportant, so long as the focus is clear. If the profit number is not Rs 3200, review what went wrong, and confirm whether it was a major or minor issue with your system.

Now at the end of the day/week/month, do the above nos tie up?

Win ratio consistently > 60%

Profit for day > allocated and utilised risk capital - if it was Rs 1600 for a particular day - your profit must be Rs 3200.

Profit for week > allocated and utilised risk capital used that week. Say Rs 4000 - Your weeks profit must be Rs 8000 at least.

Profit for month > Allocated and utilised risk capital say Rs 12000 - Your profits for the month must be Rs 24000 or more..

Stop, review and fix issues, whenever, these benchmarks are not achieved. Paper trade when you strart trading again, to ensure that you are on the right track. You NEVER lost money by not trading

Our intrepid trader Shyam, works out his risk management plan and feels that he is beginning to see light at the end of the tunnel. His earnings are now steady. He thinks about the factors that got him there. And here are some of them :

9.5 Risk Reward Management - When to enter a trade

As you progress on your trading journey and learn to trade the right price setups, there is something different that you can do to avoid wasteful trading. If you learn to estimate potential targets for the trades that you are entering, you can compare that with the stop loss you are setting. This subject is discussed at the end of this subsection, but for the moment assume that you know what the target is.

Would you trade if your potential gain is 10 points and your stop loss is set 20 points away from your trade entry price? The answer is no. You must have a reward to risk ratio greater than 1 always.If you are investing your capital and time, the returns on your trades must be reasonable. You are not trading for the sake of trading alone, but potentially to make a reasonable profit over time. A higher reward to risk ratio may sometimes increase probability of the trade to be successful.

Our normal target should be reward to risk ratios greater than 1.5 and only in exceptions where there is a potential for an upside accept a 1:1 ratio. Lets see what different ratio of Reward to Risk mean:

1.5 : 1 = 15 points profit for a 10 points stop loss.

2:1 = 30 points profit for a stop loss of 15 points.

3:1 = 36 points profit for a stop loss of 12 points.

Shyam thinks about this and the trades that did not make it to the target.

Would you trade if your potential gain is 10 points and your stop loss is set 20 points away from your trade entry price? The answer is no. You must have a reward to risk ratio greater than 1 always.If you are investing your capital and time, the returns on your trades must be reasonable. You are not trading for the sake of trading alone, but potentially to make a reasonable profit over time. A higher reward to risk ratio may sometimes increase probability of the trade to be successful.

Our normal target should be reward to risk ratios greater than 1.5 and only in exceptions where there is a potential for an upside accept a 1:1 ratio. Lets see what different ratio of Reward to Risk mean:

1.5 : 1 = 15 points profit for a 10 points stop loss.

2:1 = 30 points profit for a stop loss of 15 points.

3:1 = 36 points profit for a stop loss of 12 points.

Shyam thinks about this and the trades that did not make it to the target.

9.6 Determining Trade Targets - A simple method

Borrowing from Point and Figure methodology, here is a simple method to determine potential targets at any point of time and this is an original development not seen anywhere else on the web.

Measure the amplitude or height or difference between a swing low and the next significant swing high, ignoring any noisy movements. Take twice the difference of this value and draw the target level from the next valid retracement. If there is no retracement, the target is not valid.

Place your stop loss just below the previous swing low. Now the target is valid till the price actually drops below the swing low below which the stop loss is put. But when it does, you can easily plot the target in the opposite direction. See the illustration above. Two of the targets have been illustrated, but there are several more that can be plotted. Have fun!

Measure the amplitude or height or difference between a swing low and the next significant swing high, ignoring any noisy movements. Take twice the difference of this value and draw the target level from the next valid retracement. If there is no retracement, the target is not valid.

Place your stop loss just below the previous swing low. Now the target is valid till the price actually drops below the swing low below which the stop loss is put. But when it does, you can easily plot the target in the opposite direction. See the illustration above. Two of the targets have been illustrated, but there are several more that can be plotted. Have fun!

9.7 Success Factors - Learning to take a loss

Trading is not about always winning. Winning and losing are opposite sides of the same coin. You need to accept losses exactly the same way as you would accept your gains. Its the aggregate sum of winnings and losses which ultimately makes money for you.

Once you implement a good risk and money management strategy, you will learn that when you win you will win more than what you lose, when you make a losing trade. Thats called risk reward, and we will explore that in a new subsection, very soon.

Larry Levin says in his book "The Secret of Emotion Free Trading", “Your losing trades do not diminish you as a person. You are not your losing trades. You are also not winning your trades either. They are simply by-products of the business that you’re in.” In other words, your gains are the outcome of market movements and your risk management system.

He goes on to say "Losing trades are part of trading. The most successful traders in the world have losing trades each and every day. They do not get caught up in thinking that the losing trade is part of them. They realize it’s just part of trading, and the sooner they get rid of the losing trade, the faster they can look for the next opportunity to find a winning trade. This is easier said thandone, but nevertheless, it’s still the reality of how to make money trading."

He also quotes - Mark Douglas, author of The Disciplined Trader states, “Execute your losing trades immediately upon perception that they exist. When losses are predefined and executed without hesitation, there is nothing to consider, weigh, or judge and consequently nothing to tempt yourself with. There will be no threat of allowing yourself the possibility of ultimate disaster. If you find yourself considering, weighing, or judging, then you are either not predefining what a loss is or you are not executing them immediately upon perception, in which case, if you don’t and it turns out to be profitable, you are reinforcing an inappropriate behavior that will inevitably lead to disaster. Or, if you don’t and the loss worsens, you will create a negative cycle of pain,that once started will be difficult to stop.”

He goes on to say, “Keep in mind that fear is really the only thing that keeps us from learning anything new. You can’t learn anything new about the nature of the market’s behavior if you are afraid of what you may do or can’t do that is not in your best interests. By predefining and cutting your losses short, you are making yourself available to learn the best possible way to let your profits grow.”

If you can change what these losses mean to you and realize that getting out of a losing trade as soon as you define it as such, you will be able to release yourself from the stress that those losing trades probably cause you now. This is why learning to love taking a loss is soimportant. It puts you in a much better position to take the winning trades."

Not feeling good about a loss is a natural and instinctive reaction to a loss much like the joy of winning. We need to temper and control both of these feelings as we begin to trade.

What can you do about it? Accept the two events with the same calm emotion. Learn to switch off when you trade so that you dont get wild emotions while trading. Take a break, have a cup of coffee, anything that calms you down when a loss upsets you.

Shyam thought about the losses that he had made in his journey and the time and patience it took for him to overcome this fear.

Once you implement a good risk and money management strategy, you will learn that when you win you will win more than what you lose, when you make a losing trade. Thats called risk reward, and we will explore that in a new subsection, very soon.

Larry Levin says in his book "The Secret of Emotion Free Trading", “Your losing trades do not diminish you as a person. You are not your losing trades. You are also not winning your trades either. They are simply by-products of the business that you’re in.” In other words, your gains are the outcome of market movements and your risk management system.

He goes on to say "Losing trades are part of trading. The most successful traders in the world have losing trades each and every day. They do not get caught up in thinking that the losing trade is part of them. They realize it’s just part of trading, and the sooner they get rid of the losing trade, the faster they can look for the next opportunity to find a winning trade. This is easier said thandone, but nevertheless, it’s still the reality of how to make money trading."

He also quotes - Mark Douglas, author of The Disciplined Trader states, “Execute your losing trades immediately upon perception that they exist. When losses are predefined and executed without hesitation, there is nothing to consider, weigh, or judge and consequently nothing to tempt yourself with. There will be no threat of allowing yourself the possibility of ultimate disaster. If you find yourself considering, weighing, or judging, then you are either not predefining what a loss is or you are not executing them immediately upon perception, in which case, if you don’t and it turns out to be profitable, you are reinforcing an inappropriate behavior that will inevitably lead to disaster. Or, if you don’t and the loss worsens, you will create a negative cycle of pain,that once started will be difficult to stop.”

He goes on to say, “Keep in mind that fear is really the only thing that keeps us from learning anything new. You can’t learn anything new about the nature of the market’s behavior if you are afraid of what you may do or can’t do that is not in your best interests. By predefining and cutting your losses short, you are making yourself available to learn the best possible way to let your profits grow.”

If you can change what these losses mean to you and realize that getting out of a losing trade as soon as you define it as such, you will be able to release yourself from the stress that those losing trades probably cause you now. This is why learning to love taking a loss is soimportant. It puts you in a much better position to take the winning trades."

Not feeling good about a loss is a natural and instinctive reaction to a loss much like the joy of winning. We need to temper and control both of these feelings as we begin to trade.

What can you do about it? Accept the two events with the same calm emotion. Learn to switch off when you trade so that you dont get wild emotions while trading. Take a break, have a cup of coffee, anything that calms you down when a loss upsets you.

Shyam thought about the losses that he had made in his journey and the time and patience it took for him to overcome this fear.

9.8 Time does not decide when and how much money you will make

We set out with a clear goal that we want to earn 10000 rupees a month and deploy Rs 100000 as capital. Will we meet our objective?

The answer is No!! Confusing again?

What you make or lose in each trade is a function of your capital deployed, the capital deployed each trade, the risk that you take and when do you decide to exit your trade.

Once you study your trading pattern and the actual profits that you are making, you can test and scale up your parameters - capital and capital/trade.

Most of us have ideas about the amount of time it takes to make a certain amount ofmoney. These ideas do not apply to trading the markets. You can win and lose in minutes, because of big moves that happen in your trading direction or against it.

But you can study the patterns of your particular trading method and calibrate and adjust them so that you can meet your trading goals.That is capital deployed per trade and your trading discipline so that the trading method can be scaled up (or down).Remember that you can have 2 winning trades followed by a losing trade or sometimes no trades for a long time, based on your trading method. A trade may complete and meet your target in 5 minutes or 2 hours. There is no way of predicting when the trade will complete.

Do not attribute any emotions to the way the market treats your trade or how quickly/long it takes. The only outcome that you can control is the losses that you suffer in a trade and the time when you exit a winning trade. Thats it. Follow the discipline of the method that you have decided to treat these two outcomes and you will have consistent results.

Remember, acting in your own best interest to protect yourself is much more important than finding winning trades. Don’t get caught up in thinking the market must keep going if it moved this far, this fast. It doesn’t have to do anything, no matter what it just did. Keep yourself prepared for whatever it does and you’ll have a much better chance of holding onto your profits.

Shyam, smiled to himself. How often he thought, that if he made Rs 500 a day, he could easily make Rs 10000 in a month. Well, in reality, there were days that he made Rs 2000 and some days he lost Rs 500, but in the aggregate, he Wins more and Loses less and earns Rs 10000 a month or so.

The answer is No!! Confusing again?

What you make or lose in each trade is a function of your capital deployed, the capital deployed each trade, the risk that you take and when do you decide to exit your trade.

Once you study your trading pattern and the actual profits that you are making, you can test and scale up your parameters - capital and capital/trade.

Most of us have ideas about the amount of time it takes to make a certain amount ofmoney. These ideas do not apply to trading the markets. You can win and lose in minutes, because of big moves that happen in your trading direction or against it.

But you can study the patterns of your particular trading method and calibrate and adjust them so that you can meet your trading goals.That is capital deployed per trade and your trading discipline so that the trading method can be scaled up (or down).Remember that you can have 2 winning trades followed by a losing trade or sometimes no trades for a long time, based on your trading method. A trade may complete and meet your target in 5 minutes or 2 hours. There is no way of predicting when the trade will complete.

Do not attribute any emotions to the way the market treats your trade or how quickly/long it takes. The only outcome that you can control is the losses that you suffer in a trade and the time when you exit a winning trade. Thats it. Follow the discipline of the method that you have decided to treat these two outcomes and you will have consistent results.

Remember, acting in your own best interest to protect yourself is much more important than finding winning trades. Don’t get caught up in thinking the market must keep going if it moved this far, this fast. It doesn’t have to do anything, no matter what it just did. Keep yourself prepared for whatever it does and you’ll have a much better chance of holding onto your profits.

Shyam, smiled to himself. How often he thought, that if he made Rs 500 a day, he could easily make Rs 10000 in a month. Well, in reality, there were days that he made Rs 2000 and some days he lost Rs 500, but in the aggregate, he Wins more and Loses less and earns Rs 10000 a month or so.

9.9 Never get emotionally attached to a trade

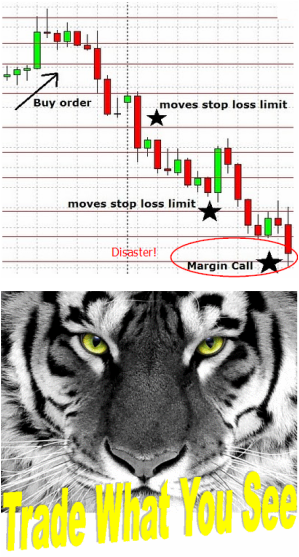

Its 9.am and the premarket trading has started. The trend seems bullish and your overnight indicators seem to suggest that it would be wise to enter a long (buy) trade. And you do that exactly 5 minutes after the market opens. The trade goes up 10 points, but then gets stuck there for the next half an hour and then starts dropping. You average the trade with another buy, because this is the REAL winning trading for you today. But then you are forced to take a loss on your new stop loss, loosing twice of what you had planned. See the second example where you move your stop loss after initiating a trade. The image says it all!

The message is clear, do not get emotionally attached to your trade. You entered, it because you believed, that it would reach its target, but if it doesnt, be ready to exit it as per your predefined rules. Do not move the goal post while the trade is in progress. Thats a cardinal sin of trading.

It is important to understand that just because you “think” something will happen in the market does not mean it will. Similarly, even if you do find a very obvious and “perfect” looking setup, you should always remember that the market is a dynamic and constantly ebbing and flowing arena where anything can happen at any time, so don’t bet the farm just because you think you have spotted a “sure-thing”, there is no such thing in the market.

Rather than allowing yourself to become emotionally attached to any trade or any idea about what the market might do, you need to learn to trade detached from your trades. Allow the price action to light your way through the noise and confusion of the market, all the while keeping in mind that you must constantly manage your risk even on trade setups that look “perfect”. Always make sure you are trading according to the concepts of your trading method and rules, and not just on a “whim”, if you are a price action trader then follow the trail left by price instead of getting off track and giving into what you think the market “should” do or “might” do.

It is one thing to fully understand exactly why you need to only trade what you see instead of what you think, and it is another thing to actually make sure you do it. Here are some concrete tips that you can use to make sure you only trade what you see and instead of giving into emotion:

• Stop and ask yourself before each trade “what I am doing?”, “what is the setup?”, “does it meet my trading plan criteria?”, “am I acting logically or emotionally?”, “am I controlling myself or is the market controlling me?”, “is there a setup or am I am just making one up”? These are all good questions to ask yourself before you enter any trade, doing this will make you think deeper about what you are doing and if a trade is warranted or if you are simply acting on emotion.

• If you are trading a specific trading strategy, like price action, make sure each trade you take is in accordance with the concepts that you have learned in. Ask yourself any or all of the above questions before every trade that you take, until it becomes second nature to only trade what you see. Eventually you will develop a refined discretionary trading perspective that will allow you to almost instantly look at a price chart and spot price action setups.

Always remember the more flexible you can be, the more successful your trading will be. In fact, the amount of money you make trading will be in direct proportion to how flexible you can be.

Larry Levin emphasises in his book "The Secrets of Emotion free trading", Being an active loser (as well as an active winner) is the only way to be successful. Again, the temptation to not cut your losses is always there. But it will do nothing but get you in trouble. Successful traders know that cutting your losses actively, before they get too large and unmanageable, is the only way!

Shyam looks back and says to himself. That was a tough one to lick! But worth its weight in gold - the messsage!!

The message is clear, do not get emotionally attached to your trade. You entered, it because you believed, that it would reach its target, but if it doesnt, be ready to exit it as per your predefined rules. Do not move the goal post while the trade is in progress. Thats a cardinal sin of trading.

It is important to understand that just because you “think” something will happen in the market does not mean it will. Similarly, even if you do find a very obvious and “perfect” looking setup, you should always remember that the market is a dynamic and constantly ebbing and flowing arena where anything can happen at any time, so don’t bet the farm just because you think you have spotted a “sure-thing”, there is no such thing in the market.

Rather than allowing yourself to become emotionally attached to any trade or any idea about what the market might do, you need to learn to trade detached from your trades. Allow the price action to light your way through the noise and confusion of the market, all the while keeping in mind that you must constantly manage your risk even on trade setups that look “perfect”. Always make sure you are trading according to the concepts of your trading method and rules, and not just on a “whim”, if you are a price action trader then follow the trail left by price instead of getting off track and giving into what you think the market “should” do or “might” do.

It is one thing to fully understand exactly why you need to only trade what you see instead of what you think, and it is another thing to actually make sure you do it. Here are some concrete tips that you can use to make sure you only trade what you see and instead of giving into emotion:

• Stop and ask yourself before each trade “what I am doing?”, “what is the setup?”, “does it meet my trading plan criteria?”, “am I acting logically or emotionally?”, “am I controlling myself or is the market controlling me?”, “is there a setup or am I am just making one up”? These are all good questions to ask yourself before you enter any trade, doing this will make you think deeper about what you are doing and if a trade is warranted or if you are simply acting on emotion.

• If you are trading a specific trading strategy, like price action, make sure each trade you take is in accordance with the concepts that you have learned in. Ask yourself any or all of the above questions before every trade that you take, until it becomes second nature to only trade what you see. Eventually you will develop a refined discretionary trading perspective that will allow you to almost instantly look at a price chart and spot price action setups.

Always remember the more flexible you can be, the more successful your trading will be. In fact, the amount of money you make trading will be in direct proportion to how flexible you can be.

Larry Levin emphasises in his book "The Secrets of Emotion free trading", Being an active loser (as well as an active winner) is the only way to be successful. Again, the temptation to not cut your losses is always there. But it will do nothing but get you in trouble. Successful traders know that cutting your losses actively, before they get too large and unmanageable, is the only way!

Shyam looks back and says to himself. That was a tough one to lick! But worth its weight in gold - the messsage!!

9.10 Your self image is important

Quoting Larry Levin, again, We all have a picture of ourselves in our subconscious. This picture is called the self image. The self-image controls everything we do in life. It is what we believe to be true about ourselves. It may not necessarily be true, but it is what we believe to be true. Our self-image has a stronger hold on us than you could ever imagine. A good example is someone trying to lose weight. Many times people have the picture of themselves as an overweight person. They attempt to try and lose weight using willpower. They go to the gym, try and eat healthier foods and avoid fatty foods. All that is great. But the reason most people can’t lose weight (or they gain it right back) is because they have that powerful picture of themselves as an overweight person fighting against them. They cant think of themselves as a fit and thin person.

The same is true about whether you deserve to make money as a trader. If you have a self-image that states it isn’t right to be able to make money so quickly, then you will be fighting a losing battle against your powerful self-image. The self-image will always win.

Just like the person trying to lose weight, you will only become successful when you have the correct picture of yourself. The picture must be of a person who is deserving of making money in the trading environment. If that is not the picture you currently have of yourself, you’ll need to change that picture. Take a cue from the picture to the left. This meek cat thinks that its a lion and therefore has the feelings of fearlessness. Dont be the girl on the left who feels weighed down by the pressure from family and peers.

Self esteem is your opinion of yourself. High self esteem is a good opinion of yourself and low self esteem is a bad opinion of yourself. Self esteem is crucial and is a cornerstone of a positive attitude towards living.

It is very important because it affects how you think, act and even how you relate to other people. It allows you to live life to your potential. Low self esteem means poor confidence and that also causes negative thoughts which means that you are likely to give up easily rather than face challenges. In addition, it has a direct bearing on your happiness and wellbeing. Some tips that can help you improve your self image:

1. Do what you love.

Everyone loves to do something, when you indulge yourself in what you love, you improve the way you feel about yourself. You improve your self image. Think about this in the context of your trading.

2. Acknowledge your strengths

There is no one who has no strengths. Everyone is good at something, know what your good at and give yourself a pat on the back. Do things that bring this quality out into the open. Excercise it, make it stronger. It will give you the confidence to do other things including trading much better.

4. Don’t put up with crap.

There is no reason you should tolerate other people being mean to you. Even if they say they are doing it with love. Make sure people know they should be nice to you and if they refuse, walk away from them. This is important in the context of people thinking that you will only lose money in trading. Only you know that if you trade smartly, you will be the winner!

6. Do your research

A lof of self help books are a waste of time in the sense that the only person who can change you is you. Reading even this section will not change you unless you get emotionally involved with the information. Which is really hard as it can sometimes feel really dry and boring. Go read biographies of people you respect, people who do positvive things and attain huge success. Look for a mentor you can help you. Its worth the money and time spent, instead of meandering around aimlessly.

The same is true about whether you deserve to make money as a trader. If you have a self-image that states it isn’t right to be able to make money so quickly, then you will be fighting a losing battle against your powerful self-image. The self-image will always win.

Just like the person trying to lose weight, you will only become successful when you have the correct picture of yourself. The picture must be of a person who is deserving of making money in the trading environment. If that is not the picture you currently have of yourself, you’ll need to change that picture. Take a cue from the picture to the left. This meek cat thinks that its a lion and therefore has the feelings of fearlessness. Dont be the girl on the left who feels weighed down by the pressure from family and peers.

Self esteem is your opinion of yourself. High self esteem is a good opinion of yourself and low self esteem is a bad opinion of yourself. Self esteem is crucial and is a cornerstone of a positive attitude towards living.

It is very important because it affects how you think, act and even how you relate to other people. It allows you to live life to your potential. Low self esteem means poor confidence and that also causes negative thoughts which means that you are likely to give up easily rather than face challenges. In addition, it has a direct bearing on your happiness and wellbeing. Some tips that can help you improve your self image:

1. Do what you love.

Everyone loves to do something, when you indulge yourself in what you love, you improve the way you feel about yourself. You improve your self image. Think about this in the context of your trading.

2. Acknowledge your strengths

There is no one who has no strengths. Everyone is good at something, know what your good at and give yourself a pat on the back. Do things that bring this quality out into the open. Excercise it, make it stronger. It will give you the confidence to do other things including trading much better.

4. Don’t put up with crap.

There is no reason you should tolerate other people being mean to you. Even if they say they are doing it with love. Make sure people know they should be nice to you and if they refuse, walk away from them. This is important in the context of people thinking that you will only lose money in trading. Only you know that if you trade smartly, you will be the winner!

6. Do your research

A lof of self help books are a waste of time in the sense that the only person who can change you is you. Reading even this section will not change you unless you get emotionally involved with the information. Which is really hard as it can sometimes feel really dry and boring. Go read biographies of people you respect, people who do positvive things and attain huge success. Look for a mentor you can help you. Its worth the money and time spent, instead of meandering around aimlessly.

9.11 Defining your trading rules

The stock market is like the wild west. You dont control it. The only thing that you can exercise is self control through your trading rules and self discipline. We have talked a bit about self discipline, but not about the the trading rules.

Trading rules are the collection of the trading method and the rules that you apply on your trades using that method.

No matter what type of trading you’re doing (swing trading, day trading, long-term trading), you’ll need to come up with your own set of rules to keep your trading structured. The problem is most people don’t want to make up their own rules, because if they did they would have to take responsibility for their results. And, as we all know, most people don’t want to take responsibility for their action. But, as we all know, the only way to be successful in trading is to take 100% responsibility and act in our own best interest.How should your rules look like?

Here are some samples :

- Every trade is a pair. A trade order and a stop loss order (manage the risk)

- Stop trading after 3 losing trades and step back to analyse (never dig your own grave)

- I will exit each trade whenever it makes 30 points profit- I will use the valid signal that my trading algorithm gives (or the method that I decide to use)

- never what a analyst on a broadcast show says.

- Avoid or reduce the trades in lean periods like holiday weeks.(volatility will be high).

- Enjoy trading and take responsibility for each of the wins and losses in all your trades.

One thing that is common in trading is the temptation to not follow your rules just this one time. This comes from the very real possibility of the exciting results that are possible. This is the trap that many new traders (and some experienced ones too) fall into. This trap is easy tofall into because many people have a terrible fear of missing out on a big move.

Follow the rules that you have decided to follow or of the trading environment that you have subscribed to. Thats a make or break approach to success in trading.Once you've defined your rules, you must execute them flawlessly. Which means following them to a "T". You may set up your compliance score card and rate yourself on each trade, whether you followed all the rules in each trade? Measurement of your compliance will give you immediate feedback on how flawlessly you are executing your rules.

Its important to separate the outcomes of the trades from the fact whether your execution was flawless or not. Many a time we mix the two up. Its important to keep the review process after trading hours and not mix that up with the outcomes during trading. Outcomes are the result of market movement and we dont control that.

So there is no point beating yourself up with the results of unsuccessful trades. Fix that in reviews of your trading method after market hours and treat that as a different corrective step.Well defined trading method rules and flawless execution are part of your daily operational success. The review of the outcomes is a post trading exercise meant to fix issues in your trading method. Keep the two separate always!

Shyam also has had problems with his emotions on the success of his trades and doubts about his trading methods. He is still working on going through his emotions to fix these. He has used a trading compliance worksheet like the one attached below to track his trades.

Trading rules are the collection of the trading method and the rules that you apply on your trades using that method.

No matter what type of trading you’re doing (swing trading, day trading, long-term trading), you’ll need to come up with your own set of rules to keep your trading structured. The problem is most people don’t want to make up their own rules, because if they did they would have to take responsibility for their results. And, as we all know, most people don’t want to take responsibility for their action. But, as we all know, the only way to be successful in trading is to take 100% responsibility and act in our own best interest.How should your rules look like?

Here are some samples :

- Every trade is a pair. A trade order and a stop loss order (manage the risk)

- Stop trading after 3 losing trades and step back to analyse (never dig your own grave)

- I will exit each trade whenever it makes 30 points profit- I will use the valid signal that my trading algorithm gives (or the method that I decide to use)

- never what a analyst on a broadcast show says.

- Avoid or reduce the trades in lean periods like holiday weeks.(volatility will be high).

- Enjoy trading and take responsibility for each of the wins and losses in all your trades.

One thing that is common in trading is the temptation to not follow your rules just this one time. This comes from the very real possibility of the exciting results that are possible. This is the trap that many new traders (and some experienced ones too) fall into. This trap is easy tofall into because many people have a terrible fear of missing out on a big move.

Follow the rules that you have decided to follow or of the trading environment that you have subscribed to. Thats a make or break approach to success in trading.Once you've defined your rules, you must execute them flawlessly. Which means following them to a "T". You may set up your compliance score card and rate yourself on each trade, whether you followed all the rules in each trade? Measurement of your compliance will give you immediate feedback on how flawlessly you are executing your rules.

Its important to separate the outcomes of the trades from the fact whether your execution was flawless or not. Many a time we mix the two up. Its important to keep the review process after trading hours and not mix that up with the outcomes during trading. Outcomes are the result of market movement and we dont control that.

So there is no point beating yourself up with the results of unsuccessful trades. Fix that in reviews of your trading method after market hours and treat that as a different corrective step.Well defined trading method rules and flawless execution are part of your daily operational success. The review of the outcomes is a post trading exercise meant to fix issues in your trading method. Keep the two separate always!

Shyam also has had problems with his emotions on the success of his trades and doubts about his trading methods. He is still working on going through his emotions to fix these. He has used a trading compliance worksheet like the one attached below to track his trades.

| trading_compliance.xlsx | |

| File Size: | 11 kb |

| File Type: | xlsx |

9.12 Your trading System - even coin tossing will work

Your trading system is a combination of a trading method and risk management.

So you could be using moving average cross overs to place trades, but you must have rules defined for your stop losses and exits or additional entries.

As mentioned in the last section, a trader with a poor trading method but with good discipline will be more successful than a trader with an excellent trading system but no discipline or process compliance.

Lets examine how you could set up a trading system with just coins tossing.

You decide that you will place a maximum of 4 trades in a day on Nifty futures and at 9 a.m. each day, you toss a coin and decide to short the market if its a heads and go long if its a tail. Your stop loss rule is exit at 10 pts. and profit rule is that you will exit at a profit level of 20 pts. You will place orders at 9:30, 11:30, 1:30 and 2:30 based on these results. Lets say 50% of the trades will succeed.

See a hypothetical set of trades.

Trade orientation at start of day using four coin tosses for four trades - Long, Long, Short, Long.

9:30 Long Trade stop losses -10 points

11:30 Long Trade achieves target +20 points

1:30 Short Trade achieves target +20 points

2:30 Long Trade fails -10 points.

What happened? Net profit = 20 points. Because we have set up that we will win more when the trade is successful and lose less when it doesnt.

Repeat this any number of times, and the results will never change!

The only factor that will change the results is that the 50% success rate drops to 40% or lower. Now that is what affects real trading systems, which dont take into account changing market dynamics like volatility.

Its important therefore, to constantly review how well your trading system performs and to adopt new methods/make changes so that your success rate remains above 50%. Couple that with a good risk and money management system as indicated earlier.

So you could be using moving average cross overs to place trades, but you must have rules defined for your stop losses and exits or additional entries.

As mentioned in the last section, a trader with a poor trading method but with good discipline will be more successful than a trader with an excellent trading system but no discipline or process compliance.

Lets examine how you could set up a trading system with just coins tossing.

You decide that you will place a maximum of 4 trades in a day on Nifty futures and at 9 a.m. each day, you toss a coin and decide to short the market if its a heads and go long if its a tail. Your stop loss rule is exit at 10 pts. and profit rule is that you will exit at a profit level of 20 pts. You will place orders at 9:30, 11:30, 1:30 and 2:30 based on these results. Lets say 50% of the trades will succeed.

See a hypothetical set of trades.

Trade orientation at start of day using four coin tosses for four trades - Long, Long, Short, Long.

9:30 Long Trade stop losses -10 points

11:30 Long Trade achieves target +20 points

1:30 Short Trade achieves target +20 points

2:30 Long Trade fails -10 points.

What happened? Net profit = 20 points. Because we have set up that we will win more when the trade is successful and lose less when it doesnt.

Repeat this any number of times, and the results will never change!

The only factor that will change the results is that the 50% success rate drops to 40% or lower. Now that is what affects real trading systems, which dont take into account changing market dynamics like volatility.

Its important therefore, to constantly review how well your trading system performs and to adopt new methods/make changes so that your success rate remains above 50%. Couple that with a good risk and money management system as indicated earlier.

9.13 Scaling up your trades

Will trading one or two contracts follow the same rules as that of 5 or more contracts?

Take Nifty futures, for example. Lets say you normally work with a 10 points stop loss. And say you exit your trades at fixed exits, say at profits of 20, 30, 50 or more points.

Will the same rules work if you start trading 10 contracts?

The answer to this lies again in your risk and money management rules. If simply multiply and scale up your 3 contract trades, you may be exposing yoursefl to a higher level of risk.

One way of managing this is to change your exit goalposts.

If you hit stop losses in your first two trades, you could say that you will reduce the exit levels of the next successful trade by 25%. So instead of exiting at a 20 point profit, you exit at 15 and 30 points. And you vary the proportion of the contracts that you exit at lower profit levels based on the success or losses that you have. For example, again, in the stop loss case, you exit more of your contracts at a lower profit than at higher levels.

If for example, I normally trade, 3 contracts in each trade and exit at 20/30 and 50 points, and I hit two consecutive stop losses. In my next trade, I may exit 2 contracts at 15 points and the last at 25 points.

You may explore other ideas like trailing stop losses and pyramiding entries, where you progressively add new trades in a trend.

Enclosed below is a trade scaling worksheet, that you can modify to suit your trading style.

Take Nifty futures, for example. Lets say you normally work with a 10 points stop loss. And say you exit your trades at fixed exits, say at profits of 20, 30, 50 or more points.

Will the same rules work if you start trading 10 contracts?

The answer to this lies again in your risk and money management rules. If simply multiply and scale up your 3 contract trades, you may be exposing yoursefl to a higher level of risk.

One way of managing this is to change your exit goalposts.

If you hit stop losses in your first two trades, you could say that you will reduce the exit levels of the next successful trade by 25%. So instead of exiting at a 20 point profit, you exit at 15 and 30 points. And you vary the proportion of the contracts that you exit at lower profit levels based on the success or losses that you have. For example, again, in the stop loss case, you exit more of your contracts at a lower profit than at higher levels.