| TradeWithMe |

MY STYLE - BLOG

|

Someone posted a blog comment requesting a good trading system.

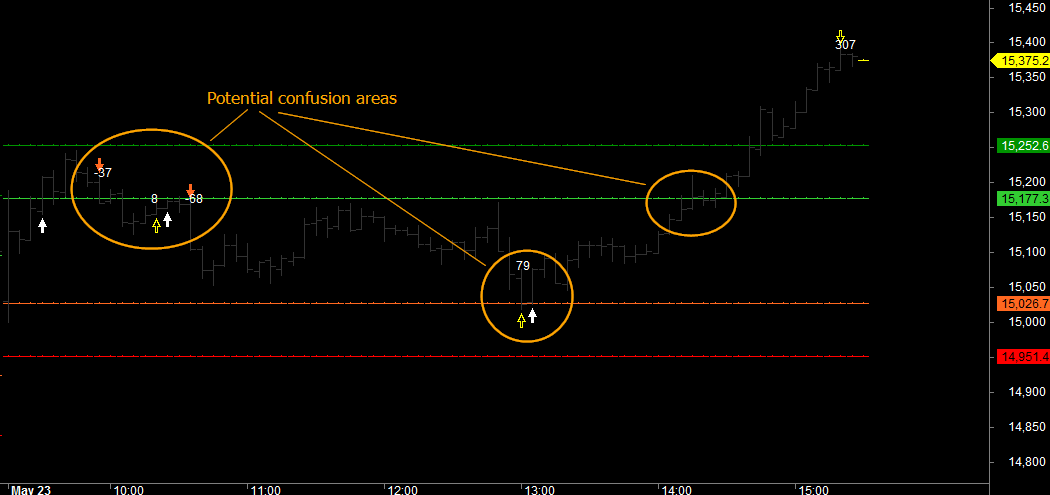

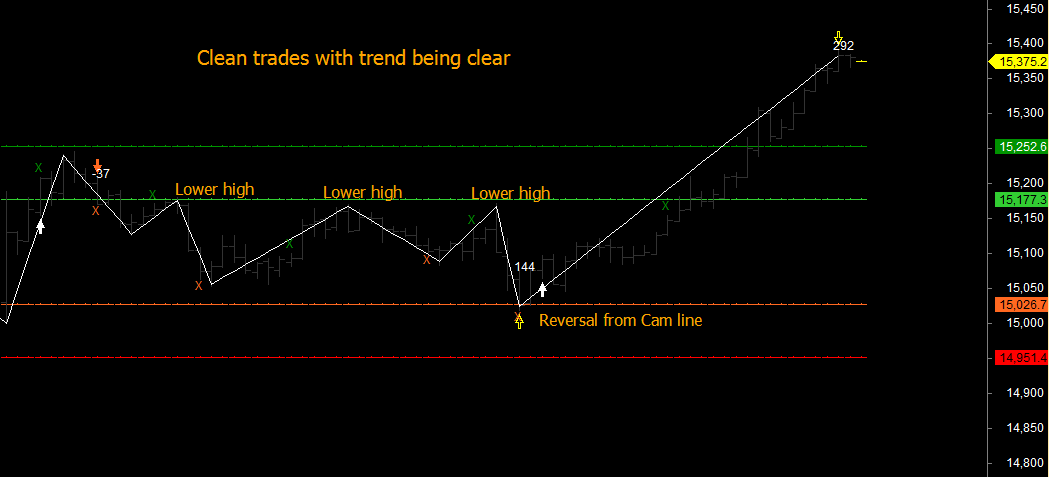

That brought a smile. People still looking for silver bullets, the money spinning strategies that will make them successful. My advice to him and all other traders is simply to focus on consistent trading with a sound risk management for targets and exits. So whether its a trend following moving averages system or a proactive level based system like Murray Math or Camarilla, work on consistent trading. As examples, see the results of our own trading this month. Perhaps the best so far in our trading history. The only thing thats changed in what we do is simply trade the trades that our systems tell us to trade and use a sound risk management approach. Run trading like a business with similar rules and discipline, and you will never go wrong. And outside of this, be innovative. Here is just one example : Improve on the traditional Camarilla system by combining it with the Gann trend for example. And you will have a several fold increase in trading accuracy, as Gann trend identifies the trend changes more accurately than several other techniques, far quicker. See the conventional Camarilla chart for BankNifty and one with a Gann trend line. AFLs for both are available on the website.

0 Comments

A simple but effective approach is that if you are quickly stopped out in your current time frame on your first or second trade, switch to a higher time frame and take the next trade only in that time setting. Keep this setting for the rest of a successful trade and switch back to the lower time frame, once you exit.

This approach effectively avoids you to take multiple ranging trades and will help you identify trend direction. |

AuthorAbnash Singh, Am a Trader helping small traders to realize their dreams. Archives

October 2017

Categories

All

|

|

Want more information ? Get in touch with us through the contact form : (click here)

|

|

RSS Feed

RSS Feed