| TradeWithMe |

MY STYLE - BLOG

|

All subjects from the website are now mapped into the forum website, allowing specific discussions on any technical or trading subject. Check the new forum website : TradeWithMeForums

0 Comments

The current TradeWithMe forum is not so user friendly and interactive. A more contemporary forum website has been created and all posts from the current website transferred there. Traders are welcome to join that site and be part of a vibrant discussion forum.

http://tradewithme.freeforums.org Those mystical levels - Open Range, Camarilla, Gann, Fibonacci, Octaves, Murray Maths. Do they work?

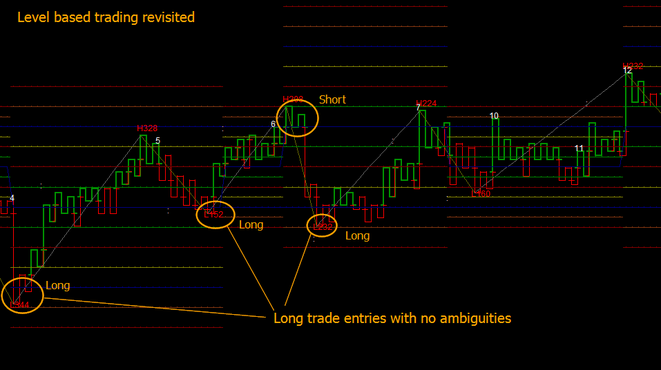

Yes, they do.. And Why? most of the time because, there are thousands of traders who believe in the sanctity of those levels and therefore, trade them like a self fulfilling prophecy. What is the real ball game? The answer is actually simple. Like any other trading method, level based trading approaches, offer a concept that is basically sound. Nearly all of them exploit the movement of the market around a golden mean: Think of a yoyo or trampoline. The harder you throw the ball or jump on the trampolene, the larger is the movement away from its on balance resting place. The markets work in exactly the same way. Finally, price returns to that golden mean and after some time creates a new wave of movement - repeating this cycle to eternity. Open range breakout works on breakouts from the golden mean. Camarilla exploits the deviations away from the golden mean - a reversal back or a breakout towards a new golden mean. Gann, takes the Camarilla concept to the next level - postulating constant multiple golden means cast in stone - around which price will oscillate, based on time movement. Fibonacci rules follow a more natural Newtonian law - what goes up comes down, and what goes down comes up. Murray maths and Octave based trading allow traders to trade from an extreme towards or away from the golden mean. Bollinger band trading allows traders to trade counter trend, when price moves more than 2 or 2.5 standard deviation width from the mean price movement. This thought is not about any of these methods, but about what is common amongst all of them. They present alternative methods for trading, which a trader can pick up and work with consistently, as they are following a natural movement which is unstoppable. A smart trader will learn to sync in with the rythm of these movements, a step, which we try to discover in our mentored trading offerings. However, most of this is common sensical knowledge, which a smart trader will learn to use : Buy when everyone is selling and Sell, when everyone is buying...... And dont trade when the market is trading around its golden mean. Isnt this simple....something that traders have spent centuries trying to do? And the answer is yes.............. THe example below is of a properly configured Octaves levels based trading system, which gives multiple long trades and a short trade. As it trades from Highs and Lows levels of the market, the failure level risk is consistently kept low. Just an idea sirji....! |

AuthorAbnash Singh, Am a Trader helping small traders to realize their dreams. Archives

October 2017

Categories

All

|

|

Want more information ? Get in touch with us through the contact form : (click here)

|

|

RSS Feed

RSS Feed