| TradeWithMe |

MY STYLE - BLOG

|

Its not good enough to just trade and make profits. There need to be several grains of consistency to ensure that trading generates a steady income, if that is one of the objectives for trading.

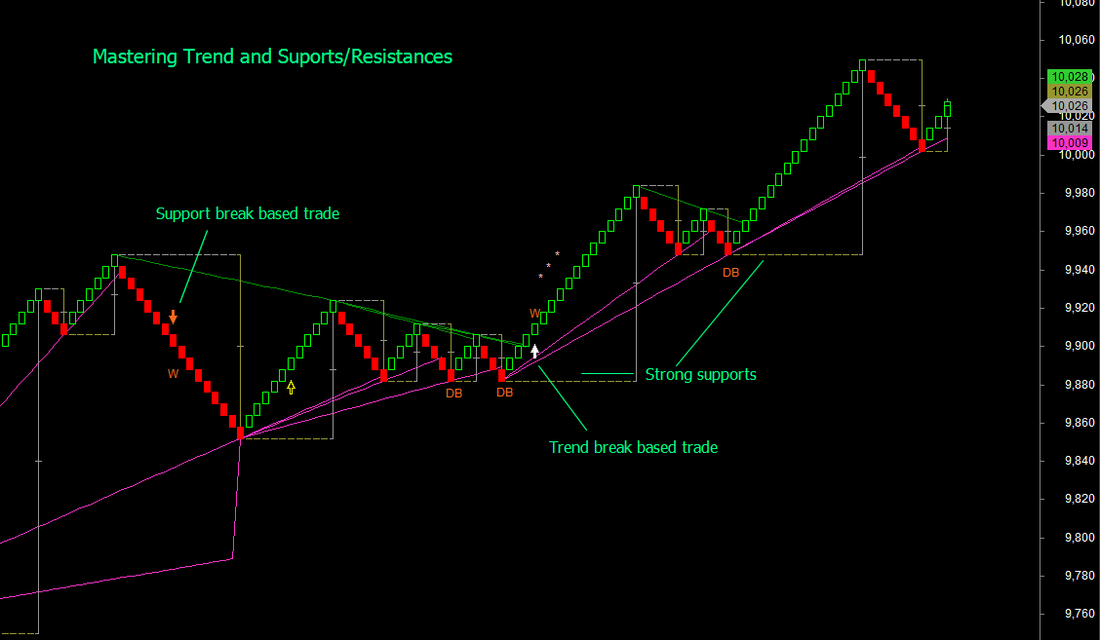

In the last post, I wrote about trading accuracy, which reduces the effort to achieve a profit level. If our trading accuracy is 70% and each winning trade makes Rs 1000 and a losing trade loses 500, then in 10 trades our profits would be 7 x 1000 - 3 x 500 = 7000-1500 = 5500 or 55% of the maximum profit potential. If our trading accuracy is 50%, the same equation turns to give a profit of 5000-2500= 2500 or 25% of the profit potential. Now, if we want an income of Rs 50000 in a month and we traded at 70% accuracy and did 10 trades in each session, we would need approximately 10 sessions to achieve this objective. If however, our accuracy is 50%, we would need to traded 20 sessions to achieve the same results. i.e. for a 20% drop in trading accuracy, we have to trade 200% more to achieve the same results. That leads me to the next important consideration, that I have been focusing for the last 6-7 months. Consistency. Consistency means, how often you can reproduce the trading accuracy, day on day....If you could consistently generate a 70% accuracy, then you can trade your method and take your winnings home day on day and live happily ever after. In the real trading world, this is less easier said, than done. The issue is with the underlying assumptions of the trading system that you use. If it cannot handle trading situations consistently... i.e. with the same level of results accuracy, then we have a problem. It is my submission, that identifying winning trades has a strong relationship to the ability to recognize supports, resistances and trend breaks. These two factors need to be in some form part of any part of the technicals of a good trading system and when combined with a good risk management system is what will make a trader win consistent profits. At TradeWithMe, we have been using the Point and Figure method for over a year and innovated around that. The original point and figure method works well, in identifying new trends, but fails in ranging periods as do most trading methods. By using our own variation of the basic point and figure method and incorporating pattern recognition in a rudimentary form at this time, we are now able to trade with close to 100% accuracy and consistency well above 70%. A sample of what could be a good trading system is shown below to give ideas to the reader:

4 Comments

|

AuthorAbnash Singh, Am a Trader helping small traders to realize their dreams. Archives

October 2017

Categories

All

|

|

Want more information ? Get in touch with us through the contact form : (click here)

|

|

RSS Feed

RSS Feed