| TradeWithMe |

MY STYLE - BLOG

|

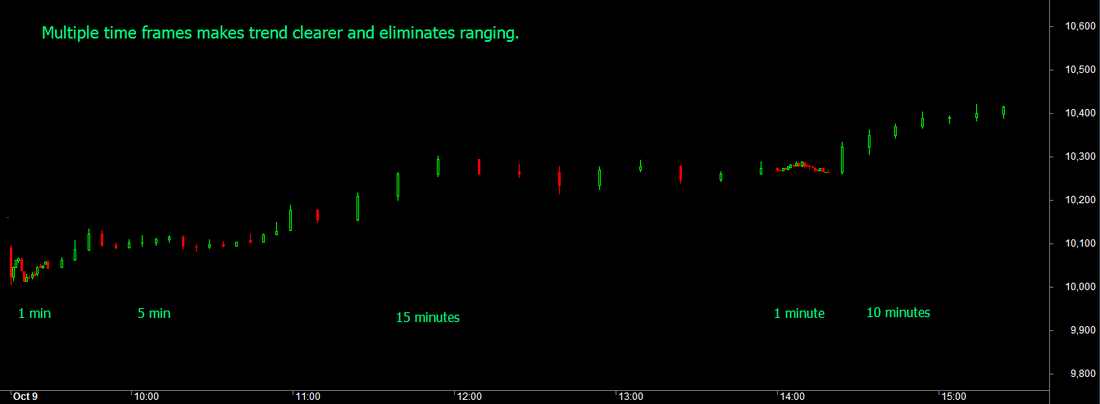

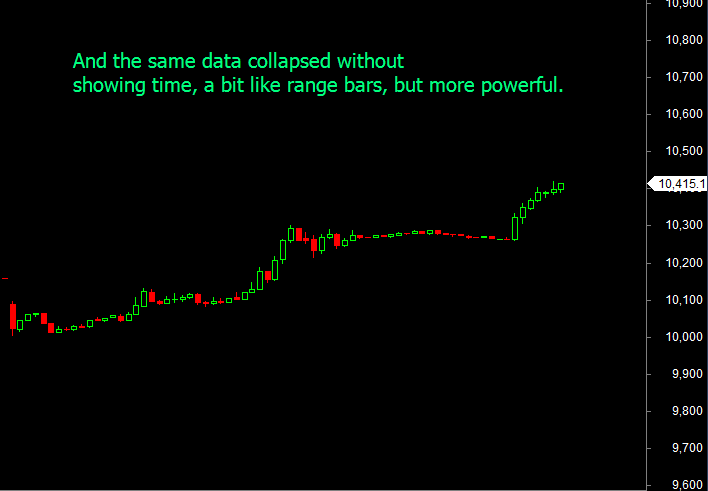

I had promised to show the impact of using a higher time frame chart during ranging periods. But instead of juggling between charts on different views, here is a method of showing the higher time frame chart on the time line of a lower time frame chart. The example is of 5 minute BankNifty futures shown along with a 1 minute chart of the same chart. Look at what happens on the higher time frame chart during ranging periods. Mini trends can be observed in the higher time frame that are not visible in the lower time frame. Now think of combining such charts so that you switch on and off higher time frame at will. Imagine the possibilities. Thats innovation at work at TradeWithMe. (click on any image to see a larger view). Now, if you thought that was neat, here is the combined chart... You can clearly now see a small ripple with two troughs, which then moves on to be part of the larger uptrend. This innovation may be small, but look at charts when in a trend. Its possible to stay stickily within the trend. See below the chart for October 9 2013

0 Comments

The only thing that matters in trading is that whats your bottom line.

Its not important that you have a great technical or fundamentals based algorithm, the fact of the matter, as we discussed a few posts ago is how often are you successful. There has to be consistency in your trading. You cannot work with a win ratio of 60% and then see 100% of your trades making losses for 2-3 days. Something is wrong, if that happens. You dont trade because you have mastered statistics. At the end of the day, do you feel happy that you traded right? (not just making money), but whether the method that you follow, is money making or a random flash in the pan. At TradeWithMe, our research has focused on why trades fail, and used that learning to improve. We were more than 150 points down on Nifty Positional trading in October till date, but in just one day today, we recovered all the losses as we realised what was not right. So what makes the difference? Its about verifying that losing trades failed your trading rule reasonably or not. If that can be evaluated objectively and you feel that you are in the 90%+ rating there, then your system is consistent. Otherwise, go back to the drawing board. Take our Fast reversal trading system for BankNifty. On October 8, we did some 17 trades with a net loss of 21 points or so. Thats pretty inefficient. On October 9, we just did 3 trades and made over 300 points, after analysing and fixing what didnt work on October 8. Its not about what went wrong, but what didnt work..... Think about this and re-invent your systems periodically. Once does go through this journey of life with experiences which betray trust.

You see so much on TV and other media of situations, where people rip you off, intentionally and by design. In the business that I am, its providers like me who are seen to be the scammers. We have tried to be different by being ethical, professional and transparent. But lurking amongst the traders that are out there, are scammers of a different kind. Unprofessional and unethical. In the service offering that we offer here, we accept intentions of traders who want to join and trade with us or those that who arent satisfied where we refund their balance monies. For the first time in my professional experience, I have had someone who agrees to subscribe a service and plays a fraud by depositing an out of date cheque in my bank account, that ultimately reaches me after ten days and enjoys free service for 10 days. Its not the money that's important, but the fact that he refuses to respond to mails or acknowledge messages. Well, thats life, and a new learning from scam street anonymous! |

AuthorAbnash Singh, Am a Trader helping small traders to realize their dreams. Archives

October 2017

Categories

All

|

|

Want more information ? Get in touch with us through the contact form : (click here)

|

|

RSS Feed

RSS Feed