| TradeWithMe |

MY STYLE - BLOG

|

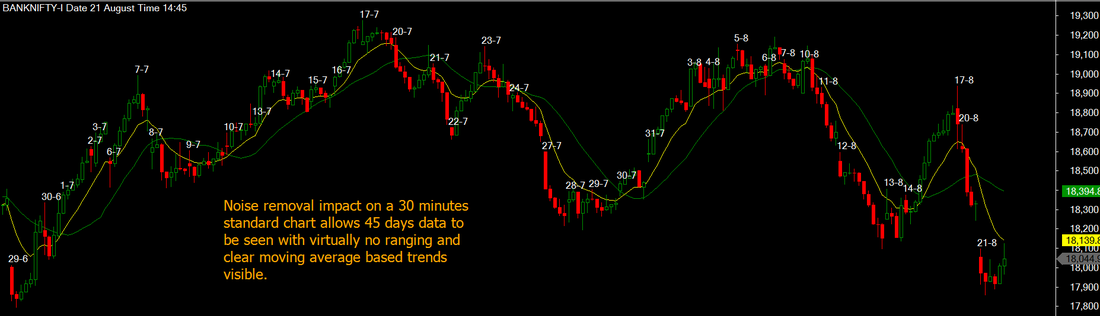

With ranging periods accounting for 50% of the price movements in most markets, we developed a new way to draw charts without the noise using principles of ignoring inside and some outside bars. No relevant data of highs and lows is ignored in the algorithm during the construction. Very interesting outcomes, which we are beginning to apply to our trading methods. See below a 5 minutes interval chart of BankNifty futures for 2.5 days. On the same period, we applied our algorithm to redraw the charts, and one can now see 14 days of data with extremely clear trends, so much so that the application of a simple moving average crossover becomes practical for trading! 5 minutes plain chart. And now the chart with the algorithm for redrawing applied on the same 5 minutes chart. Observe, how the downtrend from 11th August is captured very easily. The non linear chart that develops compresses 10 days of data on a 5 minute chart. And for comparison the closest bar chart that shows the same chart space is the 30 minutes chart, shown below. That continues to be affected by ranging in that period, while the impact is far less in the algorithmically produced chart above. We are already testing the results of this model on our other standard trading algorithms and will share some results once the tests are completed.

The algorithmic charts for 30 minutes time period (see below) show a complete absence of any ranging and show a period of 45 days versus the 10 shown in the uncompressed chart. Noise removal characteristics are better than any other methods like Point and Figure, Kagi and range bars.

1 Comment

|

AuthorAbnash Singh, Am a Trader helping small traders to realize their dreams. Archives

October 2017

Categories

All

|

|

Want more information ? Get in touch with us through the contact form : (click here)

|

|

RSS Feed

RSS Feed