| TradeWithMe |

MY STYLE - BLOG

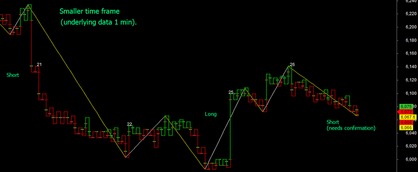

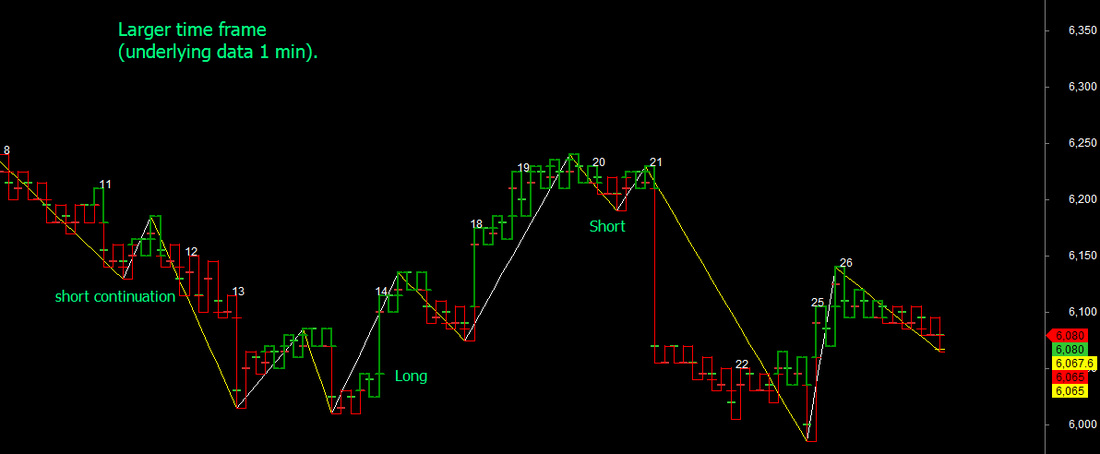

Most trading approaches use the immediate price movement patterns for trading decisions. While thats a good approach, such approaches can be difficult to manage if one does not look at multiple timeframes (for time based) and coarser views for non time based charts. One of our powerful trading methods which has been making trading more efficient in the recent days is an application of Kagi chart principles along with core Renko/Point and figure methods, resulting in a completely new chart that is different from both PnF, Renko and Kagi, though it looks like the latter. Combined with a trend recognition method thats amazingly simple but effective, results in extreme noise cancellation and a significant reduction in ineffective trades. This results in charts that effectively get closer to mechanical trading. An example is shown in the chart along side, where we have plotted the trend for NIFTY futures for intraday and positional trades. And the best part is that the core data for these charts is 1 minute time frame data demonstrating again that intraday and positional trades can be initiated from the same charts. This effort is part of the ongoing effort to simpler and more effective trading at TradeWithMe. Notice that each vertical bar in the chart may hold a few minutes, few hours or few days of data seamlessly. The bar patterns themselves have a story to tell and can be used in conjunction with the trend line. There are no ranging zones on the charts as these have been effectively filtered out by the charting technology. There is also zero lag in pattern formation as the data source is 1 minute data and no price derivatives used. One may argue that you dont need 1 minute data, however, when event based price movements occur, these are invaluable. I dont yet have access to tick data to experiment, so cannot comment on how the charts woud perform with that data source. The addon sophistication of swing logic, fib retracements etc. are other tools that one can use here without worrying about chart responsiveness. (click images for a larger view)

0 Comments

Leave a Reply. |

AuthorAbnash Singh, Am a Trader helping small traders to realize their dreams. Archives

October 2017

Categories

All

|

|

Want more information ? Get in touch with us through the contact form : (click here)

|

|

RSS Feed

RSS Feed