| TradeWithMe |

MY STYLE - BLOG

|

Technical analysts have used various methods to handle ranging periods. However, these dont work most of the time as a ranging period still appears as a range.

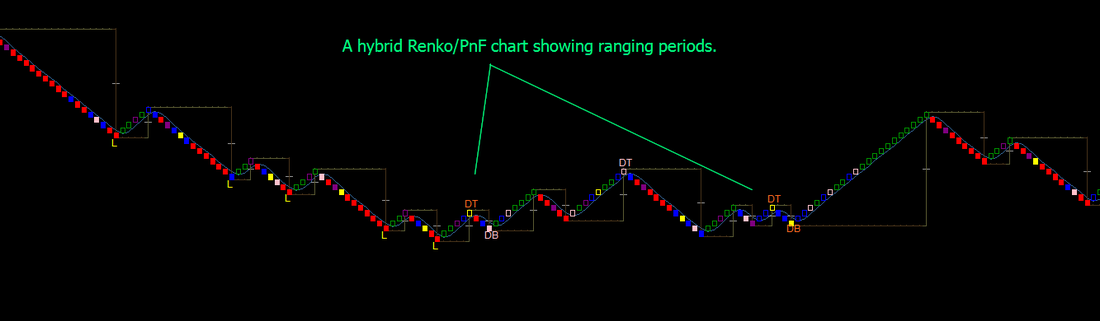

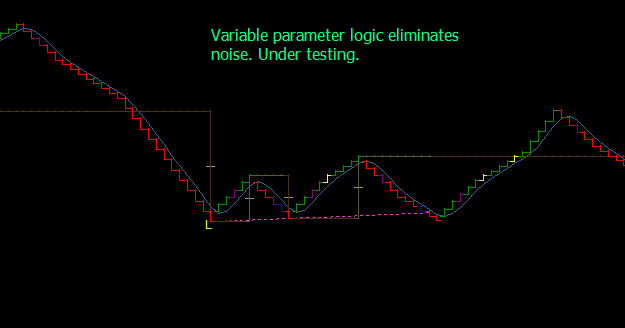

Here are some different approaches to handling ranging. Range bars for example are a part solution where noisy movement within a given amplitude is suppressed. Here are some other options : 1 - Time based compression : In this approach, one would see ranging segments within an existing time frame by changing the time frame of that period from a current level to a higher period dynamically. What this means is that one would see a 5 minute chart having a user selectable period when that part of the chart is displayed with a higher time frame. What will happen is that the ranging period will drop or disappear in the overall context of the chart. I will show the conceptual implementation of the same in a few days. 2 - Amplitude based compression - beyond range bars - where variable amplitude thresholds are implemented based on the trend. So that trends stay sticky. What that means that if a chart shows a trend, the system will automatically start increasing the amplitude of the reversal threshold so that no mid trend whipsaws affect the trades. This is perhaps one of the best kept secrets of smart technical analysts, as it is not easy to implement such a scheme. 3 - Noise less charts - Point and figure, Renko and Kagi charts eliminate noise. Change the key threshold parameters in these charts to get the same impact of amplitude based compression. This is current part of TradeWithMe's cutting edge research, where initial experiments demonstrate very good potential. See samples of what is achieved. Same data - two different logic:

2 Comments

7/10/2013 03:52:26 am

After reading your blog post I am inspired with the writing and looking forward to write a blog on the same including my view points. I will share my writing content soon! About this blog post, very informative and inspiring as well. Good Job!

Reply

Abnash

7/10/2013 08:56:07 am

Thanks for your comment. If you are inspired, thats a good end result.

Reply

Leave a Reply. |

AuthorAbnash Singh, Am a Trader helping small traders to realize their dreams. Archives

October 2017

Categories

All

|

|

Want more information ? Get in touch with us through the contact form : (click here)

|

|

RSS Feed

RSS Feed